desenvolvertalentos.ru Market

Market

How Much To Get A New Roof

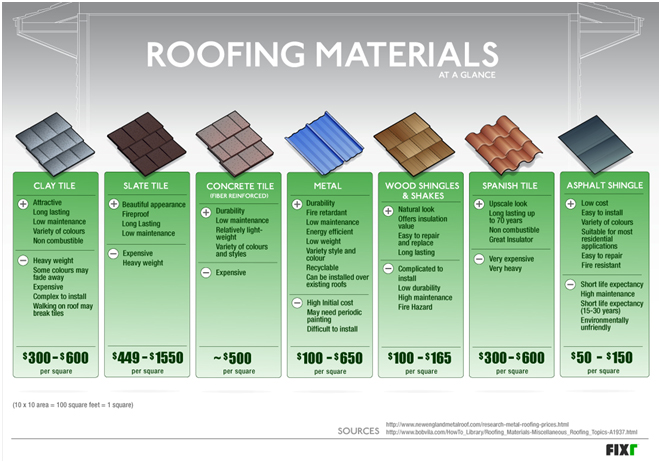

But when it comes to cost, the question lingers: just how much will a new roof set me back? Many homes have roof pitches within a range considered. It's essential to obtain multiple quotes from reputable roofing contractors to ensure you are getting a fair price for your new roof installation. Cost. Roof replacement costs $9, on average, with most homeowners spending between $5, and $13, Some homeowners may spend upward of $47, for large. When researching the average cost of a new roof, we went straight to the experts. Our team spoke with local roofers to get facts and figures as they relate to. Roof Repair Cost Guide offers cost estimates on Roof Repair in New York. Get How Much Does it Cost to Repair a Roof in New York? How Much Does it Cost to. But shingles are only one part of a roofing system! Sure, the average cost of the shingle portion of your roof may be $7,, but then you have to account for. The typical range for roof replacement costs is between $ and $, but it can be as low as $ or as high as $ Learn more about the costs. How to get a new roof for free. Securing your next roof replacement for free is unlikely, but homeowners have found ways to have their roofing project costs. roof costs vary depending on the square footage and the materials. Learn the other factors, elements, and components that go into getting a new roof. But when it comes to cost, the question lingers: just how much will a new roof set me back? Many homes have roof pitches within a range considered. It's essential to obtain multiple quotes from reputable roofing contractors to ensure you are getting a fair price for your new roof installation. Cost. Roof replacement costs $9, on average, with most homeowners spending between $5, and $13, Some homeowners may spend upward of $47, for large. When researching the average cost of a new roof, we went straight to the experts. Our team spoke with local roofers to get facts and figures as they relate to. Roof Repair Cost Guide offers cost estimates on Roof Repair in New York. Get How Much Does it Cost to Repair a Roof in New York? How Much Does it Cost to. But shingles are only one part of a roofing system! Sure, the average cost of the shingle portion of your roof may be $7,, but then you have to account for. The typical range for roof replacement costs is between $ and $, but it can be as low as $ or as high as $ Learn more about the costs. How to get a new roof for free. Securing your next roof replacement for free is unlikely, but homeowners have found ways to have their roofing project costs. roof costs vary depending on the square footage and the materials. Learn the other factors, elements, and components that go into getting a new roof.

How much does a new roof installation cost on a 2, square foot house? But let's get to the cost: Many leaks can be handled with minor repairs, so a. Calculate the cost of a new roof in three easy steps with our Pennsylvania roof cost calculator! Get a price range estimate instantly. It's a good idea to get new gutters with a new roof. BONUS: usually you can Love the Pella windows, so much quiter. Vince Galardi. The Factors: What Affects Roofing Costs? To really provide an accurate estimate of how much it will cost to replace your roof, we first have to delve a little. The actual cost depends on the size of the roof, any repairs required, and what materials you use. People are switching to metal, but. New roof: $13, – $25,*. *(These costs include construction debris But many states and localities also have laws limiting how much the final cost can. Indianapolis roof replacement is not cheap. But, this is something you need to make peace with. New roof installation, roof repairs involving the replacement of. new roof should not be the deciding factor when picking a roofing many factors, including the material you have and the characteristics of your roof. You may be able to get away with repairing or replacing the shingles on your roof — temporarily. However, it's often easier and more cost-effective to replace. When trying to find out how much your roof replacement will cost, it's Low end estimates are often what you get from smaller, new roofing contractors. The average cost of a new roof in the United States is around $ The typical range is from $ to $11,, for a basic square roof but there are. How Much Does a New Roof Cost? · A traditional architectural shingle roof will cost you around $–$ per square. Let me explain. · Well, it's like this: Each. Read on to learn about hiring roofing installation services, roof replacement costs, how to install a new roof, and more. roof replacement. The Signs You Need. Let's say you've got a 2, square foot home and you have a new asphalt shingle roof installed; the cost is going to be between $7, and $10, To get a. New vents, Yes ; Shingle type, 40 year asphalt ; Labour warranty, 10 year ; House square footage, ; Total cost, $ to $ How Much Does a New Roof in Colorado Cost? Roofing Company Colorado Question? Suburban home with new roof from a roofing company Colorado | Northern Lights. How to get a new roof for free · Apply for a grant You can access grants from different government agencies and non-profit organizations. · Roof giveaways Roofing. get a new roof. The only way to truly determine how much your roofing project is going to cost is to get an estimate from a contractor. Roofing costs can. How much is a new roof in PA? The average cost to replace a roof in make informed decisions for new roof costs in PA. Factors Influencing New Roof. The cost of re-roofing a bungalow is around $15, to $25, For a two-storey house, it can be as much as $30, For a house with a particular structure.

Calculate The Mortgage I Can Afford

Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Calculate how much you can afford for a mortgage with our easy-to-use affordability calculator. Get personalized mortgage payment estimates. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Feel confident about buying a house that you can afford. This calculator will show you how much home you can afford and at different down payment amounts. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current budget. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Calculate how much you can afford for a mortgage with our easy-to-use affordability calculator. Get personalized mortgage payment estimates. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. Feel confident about buying a house that you can afford. This calculator will show you how much home you can afford and at different down payment amounts. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. Use PrimeLending’s home affordability calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current budget.

Deciding how much house you can afford If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you. Your income plays a crucial role in determining how much house you can afford. Lenders use your income to calculate your debt-to-income ratio, which helps them. Deciding how much house you can afford If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you. The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. This rule says that your mortgage payment shouldn't go over 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps your lender. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. How much you can afford depends on your financial circumstances, such as credit score, down payment size, cash reserves, and debt-to-income ratio. Use this calculator to estimate how much house you can afford with your budget. Using a home affordability calculator. Knowing your target loan amount will help you determine how much house you can afford. In this formula, you'll use. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. What percentage of my income should go toward a mortgage? The 28/36 rule is an easy mortgage affordability rule of thumb. According to the rule, you should. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Use our home affordability tool to estimate how much house you can afford considering closing costs, mortgage, and additional fees and taxes. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you.

Building Your Own Investment Portfolio

One rule of thumb to consider is to own at least 3 or 4 stocks in at least 4 or 5 industries. This will give you relatively broad exposure and should not be so. Regular automated investing through Savings Plans · Easy buying and selling through smart orders and one‑click rebalancing · ETF Look‑through — see the companies. How to Build Your Own Investment Portfolio · 1. Define Your Financial Goal(s) · 2. Design or Modify an Investment Portfolio · 3. Execute Your Plan · 4. Maintain. What is an investment portfolio? Your investment portfolio is simply a collection of your different investments. · Asset allocation – your mix of different. Learn a few simple investing principles; Find a portfolio that meets your needs; Open a brokerage account; Purchase the necessary index funds; Rebalance once a. Creating an investment portfolio from scratch is easy if you follow a step-by-step process. And that's exactly what I'm going to show you. The first step is to decide the level of risk you're comfortable with. Higher-risk investments can generate high rewards, but they also can result in large. 1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. 1. First, measure your time horizon on the basis of age, time to retirement, and spending goals. The first step to creating a successful investment portfolio. One rule of thumb to consider is to own at least 3 or 4 stocks in at least 4 or 5 industries. This will give you relatively broad exposure and should not be so. Regular automated investing through Savings Plans · Easy buying and selling through smart orders and one‑click rebalancing · ETF Look‑through — see the companies. How to Build Your Own Investment Portfolio · 1. Define Your Financial Goal(s) · 2. Design or Modify an Investment Portfolio · 3. Execute Your Plan · 4. Maintain. What is an investment portfolio? Your investment portfolio is simply a collection of your different investments. · Asset allocation – your mix of different. Learn a few simple investing principles; Find a portfolio that meets your needs; Open a brokerage account; Purchase the necessary index funds; Rebalance once a. Creating an investment portfolio from scratch is easy if you follow a step-by-step process. And that's exactly what I'm going to show you. The first step is to decide the level of risk you're comfortable with. Higher-risk investments can generate high rewards, but they also can result in large. 1. Develop investment goals · 2. Determine your appetite for risk · 3. Work out the right investment for your risk appetite · 4. Build and monitor your investment. 1. First, measure your time horizon on the basis of age, time to retirement, and spending goals. The first step to creating a successful investment portfolio.

BUILDING A BALANCED INVESTMENT PORTFOLIO · Stocks · Aggressive portfolio allocations · 80–90% — stocks · 60–75% — stocks · 30–60% — stocks · One good way to create. Building a financial portfolio involves combining different investment assets to maximise your returns and minimise your risk. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. Expense ratios are fees mutual funds or other investment providers charge for managing investments in the funds, and are usually charged as a percentage of. We take a closer look at asset allocation and set out the four steps to build your own personalised portfolio from scratch. Finally! Provided you understand your own risk tolerance and investment timeline; it's now time to start building your investment portfolio. This is simply just. If you are planning to build your own investment portfolio of stocks, shares, bonds or other investment products, here are some factors that you can consider. Constructing an investment portfolio is about choosing a range of investments that are targeted at achieving your goals & objectives. An investment portfolio is a collection of assets holding investments like stocks, bonds, mutual funds, exchange traded funds, cash, and cash equivalents. What could I invest in? · Decide on your goals, time horizon and liquidity needs · Determine your risk tolerance · Build a portfolio · Review your investments. Index funds are boring, but better for making money. If I wanted to talk about my interesting investments at parties or wanted a new hobby, I. Structuring a portfolio · Buy and Hold a diversified portfolio of stocks · Forgo any forecasting ability · Don't let emotions get in your way · Keep. How Do You Create a Financial Portfolio? Building an investment portfolio requires more effort than the passive, index investing approach. First, you need to. Building a balanced portfolio · Start with your needs and goals. · Assess your risk tolerance. · Determine your asset allocation. · Diversify your portfolio. A portfolio is a mix of stocks, bonds and cash, as well as funds that hold a combination of these assets. BUILDING A BALANCED INVESTMENT PORTFOLIO · Stocks · Aggressive portfolio allocations · 80–90% — stocks · 60–75% — stocks · 30–60% — stocks · One good way to create. So, consider your goals as your build a stock portfolio. If you're in retirement you may want to buy more dividend paying stocks and use those payouts to help. This guide will provide you with the knowledge and resources you need to make informed decisions and create an effective investment plan that meets your needs. Determine Risk Tolerance · Explore Investment Account Types · Select Investment Types · Allocate Assets · Create Your Investment Account · Things To Keep in Mind. We'll walk you through the process of starting your investment journey, from defining your financial goals and assessing your risk tolerance to choosing a.