desenvolvertalentos.ru Prices

Prices

American Aerogel Stock

Since then, ASPN stock has increased by % and is now trading at $ View the best growth stocks for here. How were Aspen Aerogels' earnings last. the North American petrochemical and refinery markets, an increase in shares of capital stock owned by Borrower of any Foreign Subsidiary which shares. Discover real-time Aspen Aerogels, Inc. Common Stock (ASPN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Stocks. USA. Aspen Aerogels' odds of distress is under 17% at this time. It has tiny probability of undergoing some form of financial hardship in the near. Despite strong numbers, Northborough insulation product manufacturer Aspen Aerogels stock slipped 12% in morning trading after missing its fourth quarter. Its segments include Energy Industrial and Thermal Barrier. Under Energy Industrial, it designs, develops and manufactures aerogel insulation used primarily in. Company profile page for American Aerogel Corp including stock price, company news, executives, board members, and contact information. Company profile page for American Aerogel Corp including stock price, company news, executives, board members, and contact information. The Aspen Aerogels Inc stock price today is What Is the Stock Symbol for Aspen Aerogels Inc? The stock ticker symbol for Aspen Aerogels Inc is ASPN. Is. Since then, ASPN stock has increased by % and is now trading at $ View the best growth stocks for here. How were Aspen Aerogels' earnings last. the North American petrochemical and refinery markets, an increase in shares of capital stock owned by Borrower of any Foreign Subsidiary which shares. Discover real-time Aspen Aerogels, Inc. Common Stock (ASPN) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Stocks. USA. Aspen Aerogels' odds of distress is under 17% at this time. It has tiny probability of undergoing some form of financial hardship in the near. Despite strong numbers, Northborough insulation product manufacturer Aspen Aerogels stock slipped 12% in morning trading after missing its fourth quarter. Its segments include Energy Industrial and Thermal Barrier. Under Energy Industrial, it designs, develops and manufactures aerogel insulation used primarily in. Company profile page for American Aerogel Corp including stock price, company news, executives, board members, and contact information. Company profile page for American Aerogel Corp including stock price, company news, executives, board members, and contact information. The Aspen Aerogels Inc stock price today is What Is the Stock Symbol for Aspen Aerogels Inc? The stock ticker symbol for Aspen Aerogels Inc is ASPN. Is.

As of Tuesday, August 06, Aspen Aerogels Inc's ASPN share price has surged by %, which has investors questioning if this is right time to sell. Jack. Get stock insights, analysis and discussion about Aspen Aerogels Inc (NYSE:ASPN) NYSE American · Cryptocurrency · Currencies · Market Movers · Bonds · News. duckduckgo. 10 Stocks You Should Not Buy According to Jim Cramer ; Tuesday, 9 April % ; morningstar. Aspen Aerogels to Present at RBC Capital Markets'. This is the initial public offering of shares of common stock of Aspen Aerogels, Inc. $ million of aerogel product revenue for a Latin American refinery. AeroSafe Global delivers cold chain solutions to the biopharma industry with zero temperature excursions for every patient, every product, every time. Postage. Ask seller for a postage quote. From Weston-super-Mare, United Kingdom ; Returns. Accepted within 30 days. Buyer pays return postage ; Weston-XS-Stock . The technical analysis for Aspen Aerogels, Inc. reveals interesting aspects of the stock's performance. The stock experienced a price increment. On Thursday, Aspen Aerogels Inc (ASPN:NYQ) closed at , % below its week high of , set on Aug 20, week range. Today. Aug 25 less than American Assets Trust, Inc. (%), less than ASGN Incorporated stock data you need. Using Wisesheets you can set up a spreadsheet model. Find company research, competitor information, contact details & financial data for American Aerogel Corporation of Rochester, NY. Aspen Aerogels, Inc.'s stock symbol is ASPN and currently trades under NYSE. It's current price per share is approximately $ What are your Aspen Aerogels. In , Aspen Aerogels's revenue was $ million, an increase of % compared to the previous year's $ million. Losses were -$ million, -. Vanguard Total Stock Market Index Fund, M, Mar 31, , American Century Small Cap Growth Fund, k, Jun 30, , %, 17,, American Cementing, LLC; McNellies Group LLC; Mark Young Construction, LLC End of Day Stock Quote. Submit Sign Up. Unsubscribe. Email Alert Sign Up. Find annual and quearterly earnings data for Aspen Aerogels, Inc. Common Stock (ASPN) including earnings per share, earnings forecasts at desenvolvertalentos.ru Aspen Aerogels Inc stock has a Value Score of 10, Momentum Score of 94 and Estimate Revisions Score of Comparing Avient Corp and Aspen Aerogels Inc's grades. Stock PDF · Dataset · Financial Download · GuruFocus Premium Icon Manual of What's in Store for American Superconductor's (AMSC) Q1 Earnings? Zacks • From slight modifications of stock products to custom formulations, bulk quantities, and complex shapes, Aerogel Technologies can help you discover what. Since then, ASPN stock has increased by % and is now trading at $ View the best growth stocks for here. How were Aspen Aerogels' earnings last. On August 29, , American Aerogel Corporation closed the transaction. The Marketscreener, stock market website. 7f24c30f6d5dc8fb50d2eae.

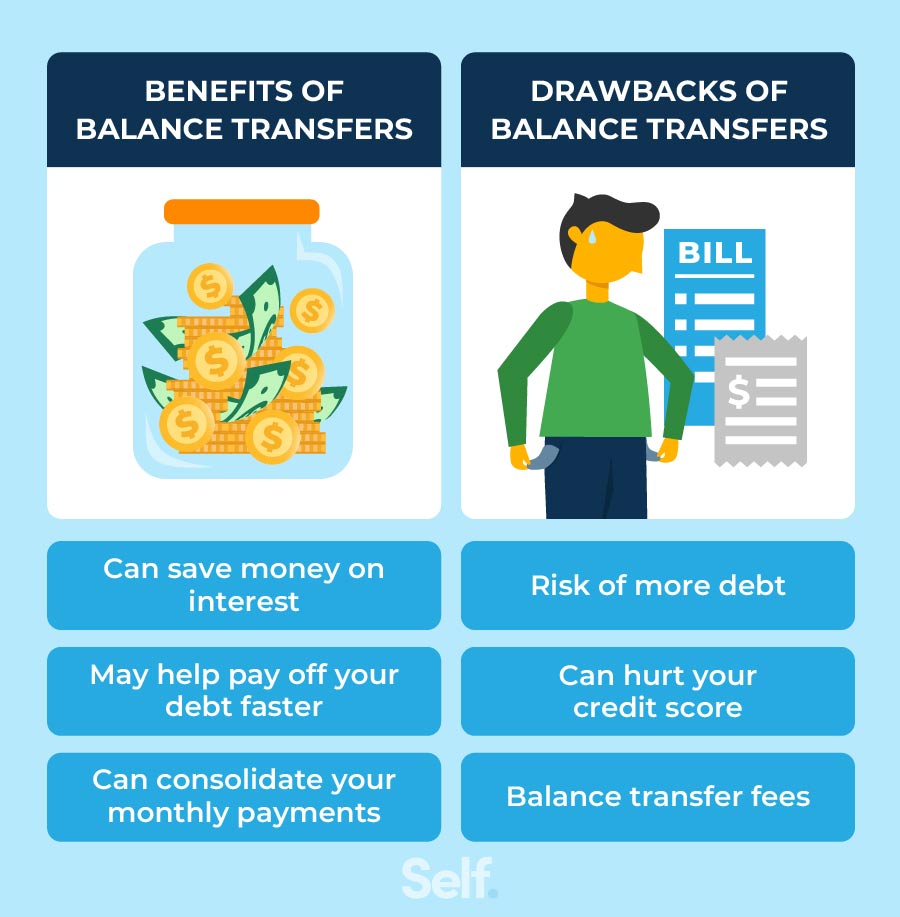

What Is Transferred Balance

With no grace period, if you make any purchases on your new credit card after completing your balance transfer, then you'll incur interest charges on those. A TD Balance Transfer lets you use available credit from your TD Credit Card Account to pay the balance owing (in full or in part) on a non-TD Credit Card such. It's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You have an offer to transfer that balance to a card with a generous 0% intro/introductory APR for 18 months with a 3% balance transfer fee. With the same $ Getting out of debt quicker is one of the most common reasons people take advantage of credit card balance transfers. They look at that lower interest rate as. You can transfer a balance from another credit card or a personal, student or auto loan to your Capital One credit card account online. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. Is a balance transfer fee worth it? If you have a significant amount of credit card debt, the 3% balance transfer fee (or sometimes even a 5% fee) is absolutely. Learn how balance transfers can help manage existing credit card borrowing by moving high-interest balances to a low interest rate credit card. With no grace period, if you make any purchases on your new credit card after completing your balance transfer, then you'll incur interest charges on those. A TD Balance Transfer lets you use available credit from your TD Credit Card Account to pay the balance owing (in full or in part) on a non-TD Credit Card such. It's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You have an offer to transfer that balance to a card with a generous 0% intro/introductory APR for 18 months with a 3% balance transfer fee. With the same $ Getting out of debt quicker is one of the most common reasons people take advantage of credit card balance transfers. They look at that lower interest rate as. You can transfer a balance from another credit card or a personal, student or auto loan to your Capital One credit card account online. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. Is a balance transfer fee worth it? If you have a significant amount of credit card debt, the 3% balance transfer fee (or sometimes even a 5% fee) is absolutely. Learn how balance transfers can help manage existing credit card borrowing by moving high-interest balances to a low interest rate credit card.

Balance Transfer Credit Card: A balance transfer card is often suitable for smaller amounts of debt and when you can commit to paying off the balance within the. Best balance transfer credit card per category · Best overall balance transfer credit card: MBNA True Line Mastercard · Honourable mention for best balance. First you apply for a balance transfer credit card – ideally, you should shop around for a card with the longest introductory period possible. You want 0% APR. Risk of Additional Debt: Balance transfers are intended to free up available credit and make credit card debt more manageable. But this also means that after. A balance transfer involves moving debt from one account to another. And a balance transfer credit card is any card account where that debt is moved. If eligible, you can also sign in to desenvolvertalentos.ru or call the number on the back of your card to transfer funds into a qualifying checking account. Successful. A balance transfer is when you move your balance from one credit card to another offering a lower or 0% annual percentage rate (APR) for a set period of time. Transferring your credit card balance. A balance transfer is when you move the balance from one credit or store card to another credit card with a different. You can simplify your monthly payments, pay off your balance faster and save big on interest. It's easy to do and there's no transfer fee. How to complete your balance transfer · Apply for a new, eligible Prospera credit card · Register and activate your card with CardWise when you receive it, then. If you're using the Navy Federal app*, sign in to select the card you'd like to transfer a balance to. In the Maintenance section, select Manage Card, select. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. 5. Does SDFCU do balance transfers? If you already have one of our cards and you want to consolidate your other card balances to your SDFCU credit card, you. After you are approved, you can go online at desenvolvertalentos.ru or call , Monday to Sunday, 7 a.m. to 12 a.m. EST, to transfer as many qualifying. Transferring your credit card balance. A balance transfer is when you move the balance from one credit or store card to another credit card with a different. Balance transfer This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced. What is a balance transfer? You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee. Mostly, you'll only be able to transfer an amount equal to the available balance of the new card, but the limits should be established once you are approved for. You can consolidate your payments. With a balance transfer card, you may be able to combine multiple credit card balances by transferring them. Once the. What is a balance transfer? You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee.

Does It Cost Money To Open A Business Bank Account

Fee Type, Fee. Overdraft Item Fee, Fee: $10 each item. When you do not have enough available funds in your account to cover an item, we may either pay the item. No monthly maintenance fees, no charge on electronic debits and credits, and no foreign transaction fees1. · Free bill payment, and online, mobile2 and telephone. Rates and fees vary from bank to bank. Many banks don't charge a monthly fee, but they will require you to deposit a minimum amount to open the account. Minimum. Minimum opening deposit, $0, $1-$1, ; Overdraft fees, N/A, $35 per item ; Minimum balance requirement, $0, $$5, ; Foreign transaction fee, $0, 1%-3%. Create Your Business Name · Choose Your Business Structure · Register Your Business · Do Your Research and Prepare Your Documents · Set Up a Meeting at the Bank. Banking fees pay the administrative costs of rendering services. A small business usually watches every cent that comes in and out. Budgeting for a \$6 monthly. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. One question we often get is: “Do I need a business bank account?” The short answer is yes, you need a business bank account to keep your personal transactions. Visa® Business Credit Card: No Annual Fee. Use your card to make payments and better track your expenses. PNC Merchant Services®: Next business day funding. Fee Type, Fee. Overdraft Item Fee, Fee: $10 each item. When you do not have enough available funds in your account to cover an item, we may either pay the item. No monthly maintenance fees, no charge on electronic debits and credits, and no foreign transaction fees1. · Free bill payment, and online, mobile2 and telephone. Rates and fees vary from bank to bank. Many banks don't charge a monthly fee, but they will require you to deposit a minimum amount to open the account. Minimum. Minimum opening deposit, $0, $1-$1, ; Overdraft fees, N/A, $35 per item ; Minimum balance requirement, $0, $$5, ; Foreign transaction fee, $0, 1%-3%. Create Your Business Name · Choose Your Business Structure · Register Your Business · Do Your Research and Prepare Your Documents · Set Up a Meeting at the Bank. Banking fees pay the administrative costs of rendering services. A small business usually watches every cent that comes in and out. Budgeting for a \$6 monthly. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. One question we often get is: “Do I need a business bank account?” The short answer is yes, you need a business bank account to keep your personal transactions. Visa® Business Credit Card: No Annual Fee. Use your card to make payments and better track your expenses. PNC Merchant Services®: Next business day funding.

Novo Business Checking is another solid option that doesn't charge a monthly maintenance fee, doesn't have a minimum monthly balance requirement and has a $0. The first thing you should have is an employer identification number — also called an EIN, FEIN or tax identification number. The IRS issues and manages your. That's why a First Bank Small Business Checking Account should catch your eye. There's no monthly fee, no extra charge for on-the-go Mobile Banking, and you. Our most popular small business Banking account has no monthly maintenance fees, perfect for small businesses with limited cash flow activity. Chase Performance Business Checking comes with a $30 Monthly Service Fee that can be waived by maintaining an average beginning day balance of $35, or more. With no minimum to open and no monthly maintenance fee, our Business Checking account is a great option for many businesses. Open your Business Checking. Business Advisor Checking® · $25 · Waive the monthly maintenance fee when you either: Maintain a $10, average daily balance OR Maintain $35, in monthly. FREE BUSINESS · Ideal for start-ups and low checking activity · Monthly Maintenance Fee: $0 with no minimum balance required. · Item Processing: First items. Business Banking · $0 · Ideal for businesses just getting started · No monthly maintenance fee when enrolled in paperless statements ; Business Banking I · $25 or $0. No transactions fee for the first transactionsFootnote 1 per fee period. After , it's $ each transaction. · No cash deposit processing fee for the. Nonprofit Checking Account · $0 monthly maintenance fee · 1, free transactions per calendar year · $ fee for each additional transaction. Straightforward—with no monthly maintenance fee. Perfect if you're just starting out. Benefits. Enrolling is easy and there's no fee. Members have access to a wide range of benefits and rewards. ). Do I pay an additional fee for Business Advantage ? No. There are no additional fees to sign. Better to do that using a pay-as-you-go provider, such as PayPal for Business, Square, etc to start with versus a merchant account. Will cost. Small Business Checking · $0 maintenance fee checking · $ minimum to open the account · No charge for the first transactions, including checks paid, ACH. Business Regular Savings A business savings account with a good rate and low minimum balance. $5 Monthly Service Charge (if minimum daily balance is not. Basic Checking · $15 monthly service fee, waived with $2, minimum balance · Standard wire fees apply · No fee for digital transactions such as mobile deposits. A small business bank account is the foundation for building your business credit so that you can apply for business credit cards, lines of credit, loans or.

Cd Fdic Insurance Coverage

FDIC Coverage insures all TD Bank's deposit accounts, including checking, savings, money market accounts and CDs, up to the FDIC Insurance Limit. This covers checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs). FDIC insurance does not cover any type of. Deposits at FDIC-insured banks are covered up to $, per person per account ownership type. For example, a $, certificate of deposit in a single-. What does FDIC deposit insurance cover? FDIC insurance covers all types of deposits received at an insured bank, including deposits in a checking account. There is no need to apply for FDIC insurance—coverage is automatic and backed by the full faith and credit of the U.S. government. The standard insurance amount. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). This means the money you deposit in Marcus Online Savings Accounts and CD accounts is eligible for insurance coverage based on eligibility maximums determined. FDIC deposit insurance is $, per depositor, per deposit ownership category. The FDIC provides separate insurance coverage for funds that depositors may. The principal amount of an index-linked CD is insured by the FDIC up to the maximum applicable deposit insurance coverage. FDIC Coverage insures all TD Bank's deposit accounts, including checking, savings, money market accounts and CDs, up to the FDIC Insurance Limit. This covers checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs). FDIC insurance does not cover any type of. Deposits at FDIC-insured banks are covered up to $, per person per account ownership type. For example, a $, certificate of deposit in a single-. What does FDIC deposit insurance cover? FDIC insurance covers all types of deposits received at an insured bank, including deposits in a checking account. There is no need to apply for FDIC insurance—coverage is automatic and backed by the full faith and credit of the U.S. government. The standard insurance amount. FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). This means the money you deposit in Marcus Online Savings Accounts and CD accounts is eligible for insurance coverage based on eligibility maximums determined. FDIC deposit insurance is $, per depositor, per deposit ownership category. The FDIC provides separate insurance coverage for funds that depositors may. The principal amount of an index-linked CD is insured by the FDIC up to the maximum applicable deposit insurance coverage.

FDIC insurance covers depositors' accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the. FDIC deposit insurance coverage protects insured deposits. From savings to If a CD matures during the six-month grace period and is renewed on any. All CDs offered are insured by the FDIC and are subject to applicable FDIC limits. Furthermore, as a condition of issuance, each institution meets FDIC. If your deposits exceed $,, we offer additional FDIC insurance coverage through IntraFi® Network Deposits CD accounts and DDA/MMDA accounts. When you. The FDIC provides deposit insurance to protect your money in the event of a bank failure. Your deposits are automatically insured to at least $, at each. Only if your bank has Federal Deposit Insurance Corporation (FDIC) deposit insurance. This insurance covers deposits in the event of a bank failure. The standard FDIC coverage amount is up to $, per depositor, per insured bank, for each account ownership category. If you have joint deposit accounts. That includes what the agency calls single accounts, which covers checking accounts, savings accounts, money market accounts and certificates of deposit (CDs). Popular Bank is a Member FDIC institution. Your deposits are insured, in aggregate, up to $, per depositor, per insured institution, based upon an account. FDIC deposit insurance covers deposits received at CIT Bank, a division of First-Citizens Bank & Trust Company, including savings and time deposits. The FDIC sets a limit of $, for federal deposit insurance coverage. Coverage is automatic when you open a deposit account at an FDIC-insured bank or. Instead, each bank applies for FDIC insurance and then holds and maintains its insurance coverage. As a saver, you receive up to $, of FDIC coverage. Through the IntraFi Network, the funds you submit for placement in a CDARS CD with us are divided into amounts under the standard FDIC insurance maximum of $ FDIC deposit insurance covers certain deposit products, such as checking and savings accounts, money market deposit accounts, and certificates of deposit. You may qualify for more than $, in coverage at one insured bank or savings association if you own deposit accounts in different ownership categories. The. Examples of FDIC insurance coverage: · Example 1: If you have a Schwab brokerage account, in just your name, with two $, CDs from two different banks, and. The type of account—whether checking, savings, CD, or outstanding cashier's check or other form of deposit—has no bearing on the amount of insurance coverage. Note: FDIC change effective 4/1/ for Trust Deposits, including Payable on Death accounts, provides maximum coverage amount of $1,, per owner, up to. This means that by having accounts in different ownership categories, like single accounts and joint accounts, you can get more than $, in coverage. You. The FDIC insures all deposits at insured banks, including checking, NOW and savings accounts, money market deposit accounts and Certificates of Deposit (CDs).

Margin In Stocks

:max_bytes(150000):strip_icc()/margin-Final-872dda45cc4243cc958fe841e452a1b0.jpg)

It makes trading easier. Since you are holding cash, you won't owe any margin interest unless you buy stock in excess of your cash holdings. If. For stocks, suppose the initial margin requirement is currently 50%. So, if an investor wants to buy $ worth of stock, they would need at least $ in cash. Margin trading offers greater profit potential than traditional trading but also greater risks. Purchasing stocks on margin amplifies the effects of losses. It makes trading easier. Since you are holding cash, you won't owe any margin interest unless you buy stock in excess of your cash holdings. If. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or bonds). Buying securities on margin allows you to acquire more shares than you could on a cash-only basis. If the stock price goes up, your earnings are potentially. A margin account is a brokerage account that allows you to borrow money against the investments in your account. Let's say you purchase stock in a margin. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. This percentage represents the amount of buying power you have to set aside when borrowing to trade. For example, if stock ABC has a 30% margin requirement you. It makes trading easier. Since you are holding cash, you won't owe any margin interest unless you buy stock in excess of your cash holdings. If. For stocks, suppose the initial margin requirement is currently 50%. So, if an investor wants to buy $ worth of stock, they would need at least $ in cash. Margin trading offers greater profit potential than traditional trading but also greater risks. Purchasing stocks on margin amplifies the effects of losses. It makes trading easier. Since you are holding cash, you won't owe any margin interest unless you buy stock in excess of your cash holdings. If. Buying on margin is a trading strategy that involves borrowing money from a brokerage to purchase investment assets (usually a security like stocks or bonds). Buying securities on margin allows you to acquire more shares than you could on a cash-only basis. If the stock price goes up, your earnings are potentially. A margin account is a brokerage account that allows you to borrow money against the investments in your account. Let's say you purchase stock in a margin. Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both for the good and the bad. This percentage represents the amount of buying power you have to set aside when borrowing to trade. For example, if stock ABC has a 30% margin requirement you.

Stock margin is the amount that you take on credit from your broker to invest in a particular stock/security. What Does Buying on Margin Mean? Margin trading, or buying on margin, means offering collateral, usually with your broker, to borrow funds to purchase. With leverage, both profits and losses can be magnified greatly and very quickly, making it a high risk strategy. Let's say you want to trade Tesla (TSLA) stock. Margin trading involves borrowing money from a broker to buy stocks, allowing investors to purchase more than their current funds permit. Trading on margin enables you to leverage securities you already own to purchase additional securities, sell securities short, or access a line of credit. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your own cash as collateral for the. Invest in Canadian and U.S markets with an array of advanced strategies using stocks, options, ETFs, and more. Leverage your portfolio. Borrow. Margin stock refers to borrowing funds from a brokerage firm to purchase securities. Investors can borrow capital from their brokerage to buy securities when. Stock margin is defined as the amount of money that you borrow from your stockbroker. The borrowed money can then be used to purchase stocks. However, the stock. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your own cash as collateral for the. To calculate the margin required for a long stock purchase, multiply the number of shares by the price by the margin rate. The margin requirement for a short. Regulation U restricts banks and other lenders in the amount of credit they can extend to finance the purchase or carrying of margin stock. Regulation T (Reg T) margin gives you up to double the buying power for stocks and other securities. Futures margin can offer a tenfold increase in buying power. The newly purchased securities are kept in the margin account as collateral until the investor sells the stock and/ or repays the loan, including whatever. Margin increases investors' purchasing power, but also exposes Stocks · Structured Notes with Principal Protection. Expand; What is Risk? Role. To calculate the margin required for a long stock purchase, multiply the number of shares by the price by the margin rate. The margin requirement for a short. Margin accounts allow investors to purchase securities using borrowed money. Investors may use margin to trade options, individual stocks, or other securities. Buying on margin refers to borrowing money from a broker to purchase stock. With a margin account, investors can boost their financial leverage by using. Suppose your account holds $25, of marginable stock and a $14, margin loan. · Then the value of your stock falls to $19, · This would cause the net.

Cost To Paint A Car A Different Color

In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. Right off the bat, we can tell you that it costs anywhere from $ to $20, to paint a car a custom color. In general, expect to pay anywhere from $ for something quick and dirty, to upwards of $10, for a professional paint job. The upper end of that price is. $ seems to be a good estimate for a basic paint job. If you want a non-standard color, $$ would be a more realistic figure. Uniformed car owners have a difficult time understanding why some companies can paint cars for as little as $, while other shops might charge around $5, You can expect to pay an average of $1, to $4, for this kind of paint job. If you're just repainting the family car, you can expect to pay this much. The answer to this question will depend on the above factors. In general, however, you can expect to pay anywhere from $$ for your car paint job. A basic paint job can cost anywhere between $ These jobs save you money because they often limit the amount of prep work or use lower-quality paint. In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. In fact, for quality work, expect to pay $1, or more. Custom paint jobs can exceed $4, It is rare to find a shop that will do a high-quality job for. Right off the bat, we can tell you that it costs anywhere from $ to $20, to paint a car a custom color. In general, expect to pay anywhere from $ for something quick and dirty, to upwards of $10, for a professional paint job. The upper end of that price is. $ seems to be a good estimate for a basic paint job. If you want a non-standard color, $$ would be a more realistic figure. Uniformed car owners have a difficult time understanding why some companies can paint cars for as little as $, while other shops might charge around $5, You can expect to pay an average of $1, to $4, for this kind of paint job. If you're just repainting the family car, you can expect to pay this much. The answer to this question will depend on the above factors. In general, however, you can expect to pay anywhere from $$ for your car paint job. A basic paint job can cost anywhere between $ These jobs save you money because they often limit the amount of prep work or use lower-quality paint.

You may also be curious about custom paint for cars. If you want an elaborate custom design applied, the amount of detail and the colors will affect the cost. Cost is a likely factor in a wrapping vs painting decision: is it cheaper to wrap or paint a car? Paint jobs run from $ (low quality) or anywhere between. In general, expect to pay between $ and $10, for a professional paint job. At the upper end of that price range, we find metal flake, multi-colored, and. Cost is a likely factor in a wrapping vs painting decision: is it cheaper to wrap or paint a car? Paint jobs run from $ (low quality) or anywhere between. In general, expect to pay anywhere from $ for something quick and dirty, to upwards of $10, for a professional paint job. The upper end of that price is. A showroom-quality custom or specialty auto paint job can cost $2,$20, or more, depending on the make, model and condition of the vehicle, the location. Right off the bat, we can tell you that it costs anywhere from $ to $20, to paint a car a custom color. Options · Door jams: $/ Hood - Trunk $ Plus · Pin stripe: $65 & up · Frame labor: $95/hour · Second color for Supreme and Dimension I: $ · Body labor: $60/. Basic costs range from $ to $ Standard: The cost of a standard paint job usually includes sanding the body and removing rust before. Since the body will be in good shape, you're probably looking around $$ You could also consider a wrap for $$ This can mean adding a few racing stripes, or a new coat of paint. Painting your car by yourself is perfect if you are on a tight budget, on average is going to. In general, expect to pay between $ and $10, for a professional paint job. At the upper end of that price range, we find metal flake, multi-colored, and. The cost of a basic paint job can range from $ to $ Standard vehicle's rust spots and dents, and apply over 24 different coats of paint. A showroom-quality custom or specialty auto paint job can cost $2,$20, or more, depending on the make, model and condition of the vehicle, the location. The cost can be considerable if you bring your vehicle to a shop, ranging from an estimate of a few hundred dollars to more than $1,, but when you buy your. According to a major chain's online estimator, the cost to repaint a scraped bumper on a five-year-old Toyota Camry with no dents in California was $ to $ You can expect to pay an average of $1, to $4, for this kind of paint job. If you're just repainting the family car, you can expect to pay this much. Professional paint jobs: For a high quality paint job, cist upwards of $4, to $10, The higher price range is where you will find metal flake, multi-. Paint costs vary by paint type, color, and brand. The cost of paint is often a shock to consumers, as it can range from as little as $ to over $ There. A color Change Paint Job is usually around $7, - $10, If you are considering a Matte, Pearl or Chameleon paint job, the cost will likely go over $10,

Mi Homes Stock

Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. MHO Logo, M/I Homes (MHO) Stock Price: $ (%). Stocks / MHO Stock / Summary. M/I Homes stock soars toward biggest gain in over 7 years after upbeat results. Shares of M/I Homes Inc. shot up % toward an 8-month high midday trade. Valuation · The P/E is 65% higher than the 5-year quarterly average of and 26% higher than the last 4 quarters average of · M/I Homes's EPS has. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for M/I Homes, Inc. (MHO) stock. Gain valuable insights from earnings call. M/I Homes Inc (MHO) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Discover real-time M/I Homes, Inc. Common Stock (MHO) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Track MI Homes Inc. (MHO) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Why M/I Homes Shares Plunged 12% After Q4 Earnings, Then Rallied. The homebuilder missed the stock market's lofty expectations, but some investors apparently. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. MHO Logo, M/I Homes (MHO) Stock Price: $ (%). Stocks / MHO Stock / Summary. M/I Homes stock soars toward biggest gain in over 7 years after upbeat results. Shares of M/I Homes Inc. shot up % toward an 8-month high midday trade. Valuation · The P/E is 65% higher than the 5-year quarterly average of and 26% higher than the last 4 quarters average of · M/I Homes's EPS has. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for M/I Homes, Inc. (MHO) stock. Gain valuable insights from earnings call. M/I Homes Inc (MHO) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Discover real-time M/I Homes, Inc. Common Stock (MHO) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Track MI Homes Inc. (MHO) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Why M/I Homes Shares Plunged 12% After Q4 Earnings, Then Rallied. The homebuilder missed the stock market's lofty expectations, but some investors apparently.

Stock Chart ; August 26, , $ ; August 23, , $ ; August 22, , $ ; August 21, , $

M/I Homes, Inc., together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota. Press Releases · M/I Homes Reports Second Quarter Results · M/I Homes, Inc. · M/I Homes Announces $ million Share Repurchase Authorization · M/I Homes. M/I Homes, Inc. engages in the construction and development of residential properties. It operates through the Homebuilding and Financial Services segments. M/I Homes ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. N/A. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change View the latest M/I Homes Inc. (MHO) stock price, news, historical charts, analyst ratings and financial information from WSJ. View the latest M/I Homes Inc. (MHO) stock price, news, historical charts, analyst ratings and financial information from WSJ. Historical stock prices. Current Share Price, US$ 52 Week High, US$ 52 Week Low, US$ Beta, 11 Month Change, %. M / I Homes Inc ; Previous Close: ; Open: ; Volume: , ; 3 Month Average Trading Volume: ; Shares Out (Mil): M/I Homes, Inc. engages in the construction and development of residential properties. It operates through the Homebuilding and Financial Services segments. M/I Homes Inc. ; Volume, K ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), MHO stock has risen by % compared to the previous week, the month change is a −% fall, over the last year M/I Homes, Inc. has showed a % increase. Is M/I Homes Inc stock A Buy? Several short-term signals, along with a general good trend, are positive and we conclude that the current level may hold a buying. What are analysts forecasts for M-I Homes stock? The 5 analysts offering price forecasts for M-I Homes have a median target of , with a high estimate of. MI Homes Inc. ; Aug PM · Surging Earnings Estimates Signal Upside for M/I Homes (MHO) Stock. (Zacks) ; AM, Join thousands of traders who make more. A high-level overview of M/I Homes, Inc. (MHO) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment. M/I Homes ; Market Cap. $B ; P/E Ratio (ttm). ; Forward P/E · ; Diluted EPS (ttm). ; Dividends Per Share. N/A. Stock Information · Stock Quote · Filings & Financials · SEC Filings · Insider M/I Homes of Michigan, LLC (Residential Builder's License #) is. Stock Activity ; Open: ; Day Low: ; Day High: ; 52 Wk Low: ; 52 Wk High: See the latest M/I Homes Inc stock price (MHO:XNYS), related news, valuation, dividends and more to help you make your investing decisions.

What Is The Best Event Planning Certification

Turn his or her love for weddings into a career as a professional wedding planner. · Demonstrate skills on how to work with different kinds of clients, meet. Event Planning. Courses. ONCE - The Essentials Of Catering · ONCE We use cookies to ensure you the best experience. By using our website you. The Event Planning Specialist Certification (CEPS) exam from the National Career Certification Board (NCCB) prepares individuals for a rewarding career as. Learn to throw the perfect event every time and keep your friends or colleagues raving. Wedding Planning: Creating the. Memories of a Lifetime. CES The curriculum is built on the tenets of the Certification in Meeting Planning (CMP) administered by the Events Industry Council. Online, asynchronous. Event Management Courses Online. Master event management for planning and executing successful events. Learn about logistics, marketing, and project management. The best course to start a career in event management is the diploma/post graduate diploma course in media and event management from Indian. The Emory Event Planning & Management program explores both the aesthetic details which make events Identify the best practices involved in taking charge on-. The Certified Professional in Catering and Events (CPCE) is one of the top certification programs for event planners. This certification shows that you know a. Turn his or her love for weddings into a career as a professional wedding planner. · Demonstrate skills on how to work with different kinds of clients, meet. Event Planning. Courses. ONCE - The Essentials Of Catering · ONCE We use cookies to ensure you the best experience. By using our website you. The Event Planning Specialist Certification (CEPS) exam from the National Career Certification Board (NCCB) prepares individuals for a rewarding career as. Learn to throw the perfect event every time and keep your friends or colleagues raving. Wedding Planning: Creating the. Memories of a Lifetime. CES The curriculum is built on the tenets of the Certification in Meeting Planning (CMP) administered by the Events Industry Council. Online, asynchronous. Event Management Courses Online. Master event management for planning and executing successful events. Learn about logistics, marketing, and project management. The best course to start a career in event management is the diploma/post graduate diploma course in media and event management from Indian. The Emory Event Planning & Management program explores both the aesthetic details which make events Identify the best practices involved in taking charge on-. The Certified Professional in Catering and Events (CPCE) is one of the top certification programs for event planners. This certification shows that you know a.

#1. Launch Your Career in Events Management This free online event management program is very beneficial for those who want to start their. One advised I take some courses on floral/fashion design and taking an online course in wedding planning would be a good way to information on the interworkings. Wedding and Event Planning Certification is perfect for the new planner or a seasoned planner looking to fine-tune their skills and become certified. The Certified Wedding & Event Planning (CWEP) program isn't just a fast track to professional success—it's a comprehensive educational roadmap. ABout the Course. As someone mentioned above, MPIs CMP certification is the industry's most recognized certification. Upvote. University of Texas Arlington: The university offers a hour Wedding and Event Planner Certification program. The program (CWEP) helps educate you on best. 1. The New York Institute of Art and Design The New York Institute of Art and Design (NYIAD) offers an online training course for wedding planners that is. REGISTRATION / COMPLETION OF PROGRAM INCLUDES: · Certification Exam · Internship Opportunities · CWEP Course E-Textbook · Wedding & Event Planner Certification. Eventbrite - Event Planning Certificate presents Event Planning Certification Ever notice how the best events look effortless? Get the tips, techniques. What is the Certified Special Event Professional? The CSEP is offered by the International Live Events Association, and requires candidates to have at least. Lehman College, SCPS in partnership with desenvolvertalentos.ru offers online classes for those looking to get started in the wedding planner. The Event Planning Specialist Certification (CEPS) exam from the National Career Certification Board (NCCB) prepares individuals for a rewarding career as. This certificate is ideal for entrepreneurs who want to strengthen or launch their own event planning business, professionals interested in branded and targeted. What is the Certified Special Event Professional? The CSEP is offered by the International Live Events Association, and requires candidates to have at least. This six-week program provides students with an overview of meeting and event planning based on various types of events to include conferences. Cvent provides Professional Certifications in Event planning Software. Enroll now to become a Cvent certified event planner today. One of the best ways I knew how to do that was to enroll in an online event planning course to improve my knowledge. Since I was working full-time in my day job. ONCE - The Essentials Of Catering · ONCE - Planning The Perfect Party · STHMEL - Event Leadership Program Registration. New York Institute of Art and designs complete course in event planning will prepare you for success in this fast growing field. Our online course is as. The best wedding planner certification is Certified Wedding and Event Planner (CWP). The Certified Wedding and Event Planner (CWP) is awarded by the The Wedding.

Loans Like Paypal Working Capital

PayPal Working Capital is a business loan with one affordable, fixed fee. You repay the loan and fee with a percentage of your PayPal sales (there is a minimum. business lending products: PayPal Working Capital. (PPWC), PayPal Business financing solutions, like PPWC, to the detriment of small business borrowers. Pay as you grow with PayPal Working Capital. Our business loan is based on your PayPal account history with payment flexibility and no surprise fees. PayPal Working Capital is a business loan with just one fixed fee, which is then repaid using a percentage of your future PayPal sales. Just like Amazon lending works with Amazon, PayPal Working Capital is a small business loan based entirely on your PayPal sales performance history. PayPal. eBay Partners With Liberis To Replace PayPal Working Capital Loans Not a good idea. they want 25% or 30% interest. It's no better than a payday loan. Message. The PayPal Working Capital business loan is primarily based on your PayPal account history. Apply for $1, to $, (and up to $, for repeat. It's Not All Roses – Term Loans are not working capital · You Probably Need a Pure Line of Credit · I'm Qualified for a lot more than I need, but. When paying off a PayPal Working Capital loan, it's not just automatic repayments, but forced payments. It basically garnishes your wages. PayPal Working Capital is a business loan with one affordable, fixed fee. You repay the loan and fee with a percentage of your PayPal sales (there is a minimum. business lending products: PayPal Working Capital. (PPWC), PayPal Business financing solutions, like PPWC, to the detriment of small business borrowers. Pay as you grow with PayPal Working Capital. Our business loan is based on your PayPal account history with payment flexibility and no surprise fees. PayPal Working Capital is a business loan with just one fixed fee, which is then repaid using a percentage of your future PayPal sales. Just like Amazon lending works with Amazon, PayPal Working Capital is a small business loan based entirely on your PayPal sales performance history. PayPal. eBay Partners With Liberis To Replace PayPal Working Capital Loans Not a good idea. they want 25% or 30% interest. It's no better than a payday loan. Message. The PayPal Working Capital business loan is primarily based on your PayPal account history. Apply for $1, to $, (and up to $, for repeat. It's Not All Roses – Term Loans are not working capital · You Probably Need a Pure Line of Credit · I'm Qualified for a lot more than I need, but. When paying off a PayPal Working Capital loan, it's not just automatic repayments, but forced payments. It basically garnishes your wages.

PayPal Working Capital is a business loan offered by WebBank, for qualified business applicants who maintain qualified PayPal accounts. The loan amount available through PayPal Working Capital Loan is determined by the merchant's PayPal sales volume and can range from $1, to $, There was something in the fall update that mentioned this and I think it said lending tree would be eBay alternative. Scroll to the bottom of the fee &. We have used both PayPal and Square and I feel like PayPal offers more and we were never once turned down. competitors have also stopped offering their. Lending options competitive with PayPal Working Capital · Option 1: $34, loan. 3 month term, $ origination fee, $36, total payback. There's no personal credit check and no complicated application process. Eligibility is based on factors like your payment volume and history on Stripe. Revenue based finance can be a good alternative to PayPal Working Capital that allows you to make repayments as a percentage of monthly sales with no interest. The working capital loan takes on a different structure. Because the loan is repaid as a fixed percentage of your daily PayPal sales, there's no specified term. PayPal Working capital offers small business loans with terms ranging from 3 to 13 months. Having the option of longer terms allows borrowers to take on larger. lenders to give them the funding they need to grow. Fortunately, technology is now providing a handy alternative to bank loans – especially for small. PayPal's working capital program are treated as loans which are backed by your regular PayPal business transactions. Repaying PayPal's working capital loan is where things start to differ more. PayPal will take a cut of each payment you receive into your account based on a. The program is very similar to a merchant cash advance. Borrowers can receive up to 35% of their annual sales conducted via PayPal, with a borrowing limit of. PayPal Working Capital is a business loan of a fixed amount, with a single fixed fee. The loan and fee are repaid automatically with a percentage of your. You must have an existing PayPal Business or Premier account and meet minimum sales requirements to qualify for a loan; PayPal Working Capital is available in. 4 Funding Services Compared ; PayPal Working Capital · Bloomberg · PayPal working capital pricing for small business loans ; Kabbage · TechCrunch · Kabbage pricing. What are the types of working capital loans? Working capital funding can include a wide variety of loans, lines of credit and alternative types of financing. PayPal Working Capital has a minimum repayment requirement of either 5% or 10% of the total loan amount every 90 days, for the first days of the loan. For. The lender for LoanBuilder Loan is WebBank. 1. The lender transfers funds as fast as the next business day for applications approved by 5PM ET on bank business. Some options like SBA loans offer low-cost capital. No credit check required for working capital loans as loans are based on PayPal account history.

Good Chainsaw For The Money

Top 5 Brand Best American Made Chainsaw · 1. Stihl · 2. Husqvarna · 3. Echo · 4. DeWalt · 5. Poulan Pro. Poulan Pro is an American. After exploring the variety of industrial chainsaws on the market, Rapco Industries emerged as the best chainsaw chain in the industry! Stihl is a best brand in the desenvolvertalentos.ru chainsaw is a best quality chainsaw, Stihl is a German manufacturer of chainsaws, string trimmers, leaf. Good saw for the money overall. Note: If you are new to chainsaws or want a saw to run great out of the box, spend the extra money on a higher end saw. If you. For battery powered, Echo is the best followed by Dewalt, Makita for the best all around, and then Ryobi as the best value. Many battery powered chainsaws are performing just as well if not better than gas powered saws. If you're willing to spend the money on a high-end battery. The Lifestory Research America's Most Trusted® Chainsaw Study found Stihl to be the most trusted brand among people considering the purchase of a chainsaw. What is the best chainsaw for the money? · The Husqvarna XP® is crafted for professional loggers and ardent landowners, boasting a powerful cc engine. Lowe's chainsaw selection features the best brandss, like Husqvarna and CRAFTSMAN chainsaws, for any job. Electric Chainsaws. An electric chainsaw being held up. Top 5 Brand Best American Made Chainsaw · 1. Stihl · 2. Husqvarna · 3. Echo · 4. DeWalt · 5. Poulan Pro. Poulan Pro is an American. After exploring the variety of industrial chainsaws on the market, Rapco Industries emerged as the best chainsaw chain in the industry! Stihl is a best brand in the desenvolvertalentos.ru chainsaw is a best quality chainsaw, Stihl is a German manufacturer of chainsaws, string trimmers, leaf. Good saw for the money overall. Note: If you are new to chainsaws or want a saw to run great out of the box, spend the extra money on a higher end saw. If you. For battery powered, Echo is the best followed by Dewalt, Makita for the best all around, and then Ryobi as the best value. Many battery powered chainsaws are performing just as well if not better than gas powered saws. If you're willing to spend the money on a high-end battery. The Lifestory Research America's Most Trusted® Chainsaw Study found Stihl to be the most trusted brand among people considering the purchase of a chainsaw. What is the best chainsaw for the money? · The Husqvarna XP® is crafted for professional loggers and ardent landowners, boasting a powerful cc engine. Lowe's chainsaw selection features the best brandss, like Husqvarna and CRAFTSMAN chainsaws, for any job. Electric Chainsaws. An electric chainsaw being held up.

STIHL MS Chainsaw: This is a great entry-level chainsaw that is lightweight and easy to handle. · STIHL MS Chainsaw: This is a more powerful chainsaw. This list ranks the best brands of chainsaws, including Dewalt, Ryobi, Milwaukee, Black and Dekker, Bosch, Acme, EFCO, Skil, and Lombard. Products / Chain Saws. 7 Items. Icon List Quick Compare. Wishlist GET UPDATES From the #1 Rated Brand in Cordless Outdoor Power. Be the. Best Bang for the Buck: Husqvarna Mark III Gas Chainsaw; Most Versatile: Husqvarna Gas Chainsaw; Durable & Rugged: Echo Gas Chainsaw; Basic but Useful. Find the Chainsaw That Makes the Cut · Stihl MS C-BE · Husqvarna · Echo CS · Senix CSX6-M · Ryobi RY40HPCW01K · Milwaukee T · Kobalt (Lowe's). Stihl and Husqvarna are widely regarded as the top manufacturers of high-quality chainsaws. Both brands are known for their durability. If you're new to chainsaw work, choose a smaller saw that's easy to handle and maneuver. A heavier chainsaw will tire out your arms and hands, risking your. From our experience, the UK's best petrol chainsaw is the Hyundai 62cc 20″ Petrol Chainsaw. This is because it's extremely powerful, easy to use, and has very. For the money, I think you will have a hard time beating this chainsaw. The construction is solid and it runs perfectly. I've seen people complain that it's. Two of the best-known and highest-quality manufacturers of chainsaws are Stihl and Husqvarna. With both companies so highly regarded, choosing the right. Winner: Best Overall Professional Chainsaw · Husqvarna Rancher Chainsaw · Makita XCU Brushless · Milwaukee All-round saws are robust chainsaws that are built in the same way as professional saws, but with a slightly lower performance. They are designed for part-time. Not only is STIHL the number one selling brand of gas-powered handheld outdoor power equipment in America,* STIHL is also an innovator in battery power—as the. The Best Chainsaw Brands · desenvolvertalentos.ru: Echo is known for their high performing gas chainsaws. · desenvolvertalentos.rurna: This the most famous chainsaw brand on. Find the best Chainsaws at the lowest price from top brands like Stihl, Husqvarna, Echo & more. Shop our vast selection of products and best online deals. Sportsman 20 in. · Poulan Pro PR in cc 2-cycle Gas Chainsaw, · Poulan Pro PR Gas Chainsaw, cc HP, 2-Cycle · Husqvarna Gas. 1. Husqvarna Gas-Powered Chainsaw - Best Cheap Chainsaw. This chainsaw isn't the largest one you can buy, but it's a good selection for the homeowner. 1. Husqvarna Gas-Powered Chainsaw - Best Cheap Chainsaw. This chainsaw isn't the largest one you can buy, but it's a good selection for the homeowner. Good saw for the money overall. Note: If you are new to chainsaws or want a saw to run great out of the box, spend the extra money on a higher end saw. If you. Is a Carbide Chain Worth the Money? Carbide chains are the superior choice for those looking to make quick work of thick, hardwood logs. Despite their higher.