desenvolvertalentos.ru Tools

Tools

How Do Ground Leases Work

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5f46970ad5967f4e5a217d3a%2F0x0.jpg)

A ground lease, in essence, is a long-term net lease of land between the lessor and lessee. Depending on the terms in the lease, a ground lease can provide the. Ground leases are used in commercial property development; the lessee has the right to Accordingly, ground lease landlords and tenants should work with real. A ground lease is a type of long-term lease agreement that allows the tenant to build on and make significant improvements to the leased property. Ground Leases Those certain leases with respect to real property that is a portion of the Leased Property, pursuant to which Landlord is a tenant and which. A ground lease is simply a long-term lease on land. The tenant is allowed to implement improvements on the land without holding ownership. A ground lease is a type of lease in which the land is not owned by the resident but the buildings on the land are. The tenant pays rent on the land that the. A ground lease is a formal agreement between a landowner and someone who wants to build property there. This is typically done by paying a monthly rent. A ground lease represents an established, long-term investment vehicle that can provide benefits to both the Lessor (landlord/Landowner) and Lessee (tenant). A ground lease involves undeveloped commercial land that is leased to tenants, who then have the rights to develop and use the property for the duration of the. A ground lease, in essence, is a long-term net lease of land between the lessor and lessee. Depending on the terms in the lease, a ground lease can provide the. Ground leases are used in commercial property development; the lessee has the right to Accordingly, ground lease landlords and tenants should work with real. A ground lease is a type of long-term lease agreement that allows the tenant to build on and make significant improvements to the leased property. Ground Leases Those certain leases with respect to real property that is a portion of the Leased Property, pursuant to which Landlord is a tenant and which. A ground lease is simply a long-term lease on land. The tenant is allowed to implement improvements on the land without holding ownership. A ground lease is a type of lease in which the land is not owned by the resident but the buildings on the land are. The tenant pays rent on the land that the. A ground lease is a formal agreement between a landowner and someone who wants to build property there. This is typically done by paying a monthly rent. A ground lease represents an established, long-term investment vehicle that can provide benefits to both the Lessor (landlord/Landowner) and Lessee (tenant). A ground lease involves undeveloped commercial land that is leased to tenants, who then have the rights to develop and use the property for the duration of the.

A ground lease encompasses undeveloped commercial land that is leased to tenants. Then, tenants have the privilege to develop and use the property during the. Ground leases are nonrecourse after construction completion and up to 36 months of rent payments can be capitalized. The Twain difference – the bridge ground. What Does Ground Lease Mean? Most cell tower leases are typically structured Remember, the cell tower companies have experts working on their behalf to. A land lease is when someone leases the land for a specific purpose. In residential properties, it is most commonly used with mobile or modular homes. Ground leases involve leasing land for a long-term period to a tenant who then constructs a structure on that property. A typical ground lease covers a period. A ground lease is a tenant/landlord agreement that states a tenant can build on an undeveloped piece of land during the leasing period. A ground lease allows a tenant to develop commercial property according to their needs. Typically, they run for terms of 50 to 99 years and provide that any. In an unsubordinated ground lease, the landowner has rights to the land, and everything built on it. If a tenant defaults, the landowner retains ownership (not. In a Ground Lease structure, the land underlying commercial real estate property is net leased on a long-term basis (typically years) by the fee owner of. Tools · A ground lease is typically a long-term lease of land. · Ground lease terms customarily run from 25 to 99 years and are generally at least 20 years. · The. Ground lease is a unique arrangement where a property's land is leased to a tenant, while the ownership of the land itself remains with the landlord. This. Typically a ground lease is a percent of the land value annually, say 10%, with 3% annual increases and a new appraisal or otherwise. Edit: Quick google search answered my question: A ground lease is an agreement in which a tenant is permitted to develop a piece of property. The developer generally finances the building, occupying it or leasing it out to other tenants, paying the landowner rent on the underlying ground over a long. Landlords can lease undeveloped commercial land to tenants, who are granted full rights to construct and operate on the property. Here's how this works. During. Bifurcation — the process of selling the underlying land, and leasing said land back under a ground lease — provides investors or developers access to low-cost. A ground lease typically restricts the ground lessee from transferring the ground lease to a third party without the ground lessor's consent. Most financeable. The developer generally finances the building, occupying it or leasing it out to other tenants, paying the landowner rent on the underlying ground over a long. How Does a Land Lease Work? A land lease involves a combination of buying a home and renting the land it sits on. This kind of agreement can be a less. How Safehold Ground Lease Works A Safehold ground lease offers a stable, long-term capital solution. It requires less equity than fee simple ownership.

Irs Treas 310 Tax Ref

I just received a direct deposit tax refund (IRS TREAS TAX REF) that does not match the amount of our refunds. img. Robin D. 15years with H. Department of Treasury are sending · and accepted through the IRS · a normal ACH direct deposit · IRS TREAS for the · a filed tax return in · Treas is a. The IRS Treas is a signal of an ACH direct deposit refund or stimulus payment from your tax return. It is a code that identifies the. form of. When Am I. What Is Tax Ref Irs Treas "IRS TREAS " is a normal automated clearing house (ACH)4. Tax Ref on. What Is Tax Ref Irs. filed tax return,. When it · timely filed their federal · or tax adjustment. If you · Payments were $1, for adults · sort, direct deposit is an · of Federal. You owe other debts, and you haven't paid: The Treasury Offset Program (TOP) allows the IRS to take or reduce your refund if you owe other types of debts. If your refund was a paper Treasury check and has been cashed: Submit a personal check, money order, etc., immediately, but no later than 21 days, to the. Pending transactions may not be the final amount that posts to account. DATE DESCRIPTION. APR. IRS TREAS - TAX REF. Miscellaneous. If you've recently received a deposit in your bank account with the description "IRS TREAS ," you might be wondering what it is and why. I just received a direct deposit tax refund (IRS TREAS TAX REF) that does not match the amount of our refunds. img. Robin D. 15years with H. Department of Treasury are sending · and accepted through the IRS · a normal ACH direct deposit · IRS TREAS for the · a filed tax return in · Treas is a. The IRS Treas is a signal of an ACH direct deposit refund or stimulus payment from your tax return. It is a code that identifies the. form of. When Am I. What Is Tax Ref Irs Treas "IRS TREAS " is a normal automated clearing house (ACH)4. Tax Ref on. What Is Tax Ref Irs. filed tax return,. When it · timely filed their federal · or tax adjustment. If you · Payments were $1, for adults · sort, direct deposit is an · of Federal. You owe other debts, and you haven't paid: The Treasury Offset Program (TOP) allows the IRS to take or reduce your refund if you owe other types of debts. If your refund was a paper Treasury check and has been cashed: Submit a personal check, money order, etc., immediately, but no later than 21 days, to the. Pending transactions may not be the final amount that posts to account. DATE DESCRIPTION. APR. IRS TREAS - TAX REF. Miscellaneous. If you've recently received a deposit in your bank account with the description "IRS TREAS ," you might be wondering what it is and why.

Toll-free; International; The IRS welcomes calls via your choice of relay. Deaf or hard of hearing taxpayers using a relay service may. M posts. Discover videos related to Why Did I Get A Irs Treas Tax Ref Today on TikTok. See more videos about Irs treas Tax Ref on My Tax Refund. I randomly received a. Ppd Irs Treas refund or stimulus payment from a filed tax return, where. into your checking account may. Ppd Irs Treas we received earlier this year. · MISC PAY. An Economic Impact · If your income tax refund · Economic Impact Payment (known as · US Treasury? Did the IRS · first. IRS Treas Tax Ref · The IRS Treas Tax Ref is a code that signifies an ACH direct deposit refund or stimulus payment resulting from a. Treasury/IRS rules and regulations interpret the law. The IRC was amended by refund, often lacking sufficient information to determine a tax liability. we received earlier this year. · MISC PAY. An Economic Impact · If your income tax refund · Economic Impact Payment (known as · US Treasury? Did the IRS · first. They threaten arrest, suspension of SSNs, and/or high penalties. The IRS is asking taxpayers who receive unexpected tax refunds via direct deposit to contact. Department of Treasury are sending · and accepted through the IRS · a normal ACH direct deposit · IRS TREAS for the · a filed tax return in · Treas is a. The IRS warns taxpayers to be on the lookout for a new scam mailing that tries to mislead people into believing they are owed a refund. IRS TREAS signals an ACH direct deposit refund or stimulus payment resulting from a filed tax return, amendment, or tax adjustment. IRS ACH tax refund credit entry (including an individual's Social Security Number). The company name will be 'IRS TREAS ' The company entry description. IRS TREAS CHILDCTC”. If the eligible individual received advance Child Tax Credit payments through Treasury checks by mail, the description on those. What is the payment for? IRS TREAS + TAX REF, TAXEIP3 or CHILDCTC explained. desenvolvertalentos.ru tip-got-a-. a surprising check in the mail? IRS Treas Tax Ref: What It Means and How to Handle It ⤵️ #saasant #tax #accounting #finance #bookkeeping. IRS TREAS " and Company Entry Description including "_TAX REF"; Treasury The institution's policies for posting and returning IRS tax refunds; The. I randomly received a. Ppd Irs Treas refund or stimulus payment from a filed tax return, where. into your checking account may. Ppd Irs Treas will Nicole pay on a. Irs Treas Co Entry Descr Tax Ref Sec Ppd your money that the government owed you. An economic impact. What is the payment for? IRS TREAS + TAX REF, TAXEIP3 or CHILDCTC explained. desenvolvertalentos.ru tip-got-a-. REF.; If you receive $ Irs Treas Tax Ref Mean tax ">What is IRS TREAS and how is it. return, including an amended tax. Irs Treas Tax Ref Mean.

Second Home Investment

% debt free. k saved for a second home plus k saved for a perpetual operating fund. (We don't need the money for retirement). FHA & VA loan programs are ineligible for the purchase of a Second Home. · The minimum down payment for the purchase of a Second Home with a conventional loan is. The Pros and Cons of Buying a Second Home · Pro: Vacation Rental Income · Pro: Tax Benefits · Pro: Potential Appreciation · Con: The Challenge in finding renters. If a second home fits into your financial plan, it can be a rewarding way to accomplish your goals, providing income, years of memories and a legacy for your. Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard 20% down payment. Owning a second home in a beautiful location creates plenty of opportunities to rent it out so others can enjoy it. The resulting income can also help with. Owning a second property becomes a federal question and you could substract a big chunck of the mortgage in your taxes. Lenders consider properties that are used as second homes—rather than as investment properties—to be less risky, which means you may be able to qualify for a. Basically, if you buy real estate that you'll use just to make a profit rather than as a personal residence for you and your family to visit at times, that. % debt free. k saved for a second home plus k saved for a perpetual operating fund. (We don't need the money for retirement). FHA & VA loan programs are ineligible for the purchase of a Second Home. · The minimum down payment for the purchase of a Second Home with a conventional loan is. The Pros and Cons of Buying a Second Home · Pro: Vacation Rental Income · Pro: Tax Benefits · Pro: Potential Appreciation · Con: The Challenge in finding renters. If a second home fits into your financial plan, it can be a rewarding way to accomplish your goals, providing income, years of memories and a legacy for your. Interest rates for second homes are slightly higher than primary home mortgages, and you may need more than the standard 20% down payment. Owning a second home in a beautiful location creates plenty of opportunities to rent it out so others can enjoy it. The resulting income can also help with. Owning a second property becomes a federal question and you could substract a big chunck of the mortgage in your taxes. Lenders consider properties that are used as second homes—rather than as investment properties—to be less risky, which means you may be able to qualify for a. Basically, if you buy real estate that you'll use just to make a profit rather than as a personal residence for you and your family to visit at times, that.

Loans up to 80% of a home's value are available on a purchase or refinance with no cash back dependent on occupancy type. These loans are subject to property. Conventional loans for a second home require a 10% minimum down payment for a second home, while jumbo loans require a minimum of 20% or more. This differs from. Mortgage loans for second homes typically carry noticeably higher interest rates than their primary residence counterparts, and can require the borrower to have. You can deduct the home mortgage interest and property taxes for a second home against your personal income, the same as you do with your primary residence. To. “A second home must be called an investment property if you're not spending at least two weeks of your year at the home and are renting it out to individuals –. The Pros and Cons of Buying a Second Home · Pro: Vacation Rental Income · Pro: Tax Benefits · Pro: Potential Appreciation · Con: The Challenge in finding renters. Get a mortgage loan If your second home can be used year-round, you can get financing for up to 95% of its value. If it's a seasonal cottage, you can get. There are several key advantages to buying a second home for a rental property, notably tax advantages, such as deductions for interest, insurance, and other. One out of three homes sold in was a vacation home or investment property, showing that demand for second homes remains healthy despite a slow housing. If you are planning to purchase a second home, you'll want the best possible financing for your new real estate investment. There's no question that. The survey found that financial advisors most often recommend leveraging the second home as an investment property (46%) and utilizing securities-based lending. Though you may be able to rent out your second home on a short-term basis, you cannot count that anticipated income in your DTI calculation. If your home is an. You may be able to deduct mortgage interest, property taxes, operating expenses, depreciation and repairs, depending on how you use your second home. A home equity loan allows you borrow against your home equity as well but instead of replacing your mortgage, it acts as a second one. You'll be making separate. Most lenders require a down payment of at least 10% on a vacation home.4 The amount may be even higher if it's an investment property. Every lender uses. A second home is a substantial investment that lives by different rules than your primary residence. Review your options and potential tax consequences. If you're thinking about buying a second house, like an investment property, a second mortgage can help you achieve that goal. Here are a few things to know. 5 steps to buy a second home and rent the first · 1. Assess your financial situation · 2. Find money for another down payment · 3. Ensure the first home will. A second home can only be rented out for a profit for fewer than 14 days, according to the IRS, so an investment property can generate a much larger profit than. The Pros and Cons of Buying a Second Home · Pro: Vacation Rental Income · Pro: Tax Benefits · Pro: Potential Appreciation · Con: The Challenge in finding renters.

What To Do When You Get Your First Credit Card

The key to using your first credit card is to limit charges to those that you can afford to pay off — and then making sure you do so in a timely manner. Doing. Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. Keep your card for planned purchases, take your time finding the best deals and make sure you have a plan to pay off the purchase before you buy it. More from. The main types of credit card · Credit builder cards. If you don't have a history of borrowing or your credit rating could do with a boost, this might be the. 1. Your first step in building credit may require you to make a deposit · 2. Shop around before you apply · 3. Pay your bill on time, in full (not just the. On average, a person's first credit card will come with a credit limit of $ to $1, However, it can go as low as $ As you continue to make on-time. While you can sign up for your first credit card at 18, it's best to wait until you have confidence in your ability to pay off your balances on time and in full. Make sure you consider your borrowing needs and other options, including loans or car finance. · To compare credit cards, consider the representative APR, fees. 2. How does a credit card help me build credit? · Make purchases and pay on time: Showing creditors that you're capable of handling debt and showing that you can. The key to using your first credit card is to limit charges to those that you can afford to pay off — and then making sure you do so in a timely manner. Doing. Start by thinking about what you want to use the credit card for. This could be to buy things on line or on holiday, to pay your bills or to spread the cost of. Keep your card for planned purchases, take your time finding the best deals and make sure you have a plan to pay off the purchase before you buy it. More from. The main types of credit card · Credit builder cards. If you don't have a history of borrowing or your credit rating could do with a boost, this might be the. 1. Your first step in building credit may require you to make a deposit · 2. Shop around before you apply · 3. Pay your bill on time, in full (not just the. On average, a person's first credit card will come with a credit limit of $ to $1, However, it can go as low as $ As you continue to make on-time. While you can sign up for your first credit card at 18, it's best to wait until you have confidence in your ability to pay off your balances on time and in full. Make sure you consider your borrowing needs and other options, including loans or car finance. · To compare credit cards, consider the representative APR, fees. 2. How does a credit card help me build credit? · Make purchases and pay on time: Showing creditors that you're capable of handling debt and showing that you can.

What to Do to Qualify for a Credit Card When you have looked at what you want a credit card for, and your budget shows that you are in a position to pay off. They can help you build a strong credit score if you make payments consistently over time. Credit union credit cards. Don't just shop for the big names like. First, pay your credit card balances in full each month. As convenient as cards are, they are a terrible way to borrow money. If you need to. Spend within your means. Set up autopay or at least make sure to pay before the due date. 6 months from now, aim to get a card with good cash back/points and. How to get your first credit card: 5 tips · 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options. How to get your first credit card: 5 tips · 1. Check credit scores and credit reports · 2. Consider beginner credit cards · 3. Explore rewards credit card options. Apply for a secured credit card. Try for this at the bank or credit union where you have a checking or savings account. Here's how it works: They give you a. When you use a credit card for the first time, the key is to spend within your means and pay the bill on time and in full every month. This will help you build. To open a new credit card account, you must be 18 years of age or older. However, the best time for a person to get their first credit card is when they are. If you can, it's best to get a card with no annual fee. This means you won't have to pay the lender just for having an account with them. Watch out for other. Applying for your first credit card is a major financial milestone. So what should you do to make sure you're building good credit with it? Your best bet is. How to Apply for Your First Credit Card · Fill out an application with your personal info: Fill out your personal information as asked on the card's website . Keep in mind that you must be at least 18 years old to be the primary account holder of a credit card. We recommend you wait to apply for a credit card until. A good place to start is by getting a credit card through your primary bank. Many banks are more likely to approve credit card applications if you have other. Don't be a card counter. If you have multiple cards, it can be tempting to spend more than you intended. Also, it makes your wallet fat which makes for uneven. What to look for in a first-time credit card If you don't have a credit history and are considering your first credit card, there are a few things to consider. First, pay your credit card balances in full each month. As convenient as cards are, they are a terrible way to borrow money. If you need to. What do I need to apply for a credit card? Before giving them a credit card, you may want to provide a debit card that deducts money directly from their bank account. That way, they can adjust to the. So a $ deposit corresponds to a $ credit limit. As they spend and then pay back the money, they'll improve their ability to spend within these defined.

Product Price Promotion Placement

A business tool used in marketing products; often crucial when determining a product or brand's unique selling point. Often synonymous with the four Ps: price. A core part of its marketing strategies involves using trait positioning so that it can promote the benefits of its products to a particular target audience. The four primary elements of a marketing mix are product, price, placement, and promotion. This framework aims to create a comprehensive plan to distinguish a. Place strategy is just one part of your overall marketing strategy, so be sure to consider the three other Ps of product, promotion and price when you decide on. The 4 Ps are the key factors in marketing a product or service to consumers: product, price, place, and promotion. They are also known as a marketing mix. The 4Ps of marketing (Product, Price, Promotion, and Place) are a fundamental framework for creating a successful product marketing strategy. The 7 Ps—product, price, place, promotion, people, positioning and packaging—are known as the marketing mix. These are the elements a company uses to. Product; Price; Place; Promotion; Packaging; Positioning. What Does Positioning Mean In The Marketing Mix? Positioning Marketing Mix Definition. Positioning. The 5 P's of Marketing – Product, Price, Promotion, Place, and People – are key marketing elements used to position a business strategically. A business tool used in marketing products; often crucial when determining a product or brand's unique selling point. Often synonymous with the four Ps: price. A core part of its marketing strategies involves using trait positioning so that it can promote the benefits of its products to a particular target audience. The four primary elements of a marketing mix are product, price, placement, and promotion. This framework aims to create a comprehensive plan to distinguish a. Place strategy is just one part of your overall marketing strategy, so be sure to consider the three other Ps of product, promotion and price when you decide on. The 4 Ps are the key factors in marketing a product or service to consumers: product, price, place, and promotion. They are also known as a marketing mix. The 4Ps of marketing (Product, Price, Promotion, and Place) are a fundamental framework for creating a successful product marketing strategy. The 7 Ps—product, price, place, promotion, people, positioning and packaging—are known as the marketing mix. These are the elements a company uses to. Product; Price; Place; Promotion; Packaging; Positioning. What Does Positioning Mean In The Marketing Mix? Positioning Marketing Mix Definition. Positioning. The 5 P's of Marketing – Product, Price, Promotion, Place, and People – are key marketing elements used to position a business strategically.

Apple Inc.: The tech giant has mastered the art of creating innovative products (Product) and positioning them at a premium price (Price). The four Ps — product, pricing, placement, and promotion—drive marketing. Marketers use these four pillars to reach their target audience and achieve their. The marketing mix is the combination of the four controllable variables–product, place, promotion, and price (the four Ps)–people are sometimes added. It encompasses Product, Price, Placement, and Promotion, and has evolved into what we now know as the 7 P's of marketing: Product, Price, Promotion, Place. A marketing mix includes the 4 Ps of marketing: product, place, price, and promotion. Learn how to effectively plan and market your next product! The four Ps of marketing: product, price, place and promotion. The marketing mix can be divided into four groups of variables commonly known as the four Ps. Successful marketing is the act of putting the right product, in the right place, at the right time and price. Occasionally service marketers will refer to 8 Ps (product, price, place, promotion, people, positioning, packaging, and performance), comprising these 7 Ps. You just need to create a product that a particular group of people want, put it on sale some place that those same people visit regularly, and price it at a. The 4Ps of marketing (Product, Price, Promotion, and Place) are a fundamental framework for creating a successful product marketing strategy. The marketing mix, also known as the four P's of marketing, refers to the four key elements of a marketing strategy: product, price, place and promotion. Marketers must know how consumers view the types of products their companies sell so that they can design the marketing mix to appeal to the selected target. Let's start by defining each of the Four Ps · Product · Price · Place + Positioning · Promotion. Even the best marketing plan (the positioning or product strategy as represented by a brand's core benefit proposition plus the 3 P strategies) will have. The essential base ingredients of the 4 P's are: Product, Price, Place and Promotion. While this combination doesn't appear to be rocket science, a company's. Pricing in the marketing mix. Pricing is one of the four main elements of the marketing mix. Pricing is the only revenue-generating element in the marketing mix. A higher priced product often implies high quality, and consumers expect more value from the result of their purchase. You can test levels of pricing for. The successful marketing mix of the 4 P's can be summed up as having the right product, in the right place, at the right price with the right promotion. Next, we discussed pricing those products to convey value to the customer. The last leg of the 4-P journey is promotion. I left promotion for last because it is. Next, the price is determined based on the costs and customers' perception. Finally, the product is communicated and promoted via different channels like TV.

Axle Financial

Axletree Solutions is a top financial technology solutions provider offering services like bank connectivity, enterprise financial management. View today's American Axle & Manufacturing stock price and latest AXL news and analysis. Create real-time notifications to follow any changes in the live. desenvolvertalentos.ru is Axle Lending is more than just financing, we offer a wide range of financing options including a 1 page application for up to $ This rating has increased by 2% in the past 12 months. Financial Analyst professionals have also rated American Axle & Manufacturing with a rating for work-. American Axle and Manufacturing Holdings Inc Financial Summary The current AXL market cap is M. The company's latest EPS is USD and P/E is -. American Axle & Manufacturing Holdings Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View AXL financial. Get the financing you need! We have custom programs with credit lines to fit your unique dealership needs! Savvy dealers choose AXLE Funding (formerly. American Axle & Manufacturing (AXL) financials statements overview reports - American Axle & Manufacturing's market cap is currently ―. Overview Financials include data about a family's assets, income and loans. Family Financials Estimations of a family's financial details. Axletree Solutions is a top financial technology solutions provider offering services like bank connectivity, enterprise financial management. View today's American Axle & Manufacturing stock price and latest AXL news and analysis. Create real-time notifications to follow any changes in the live. desenvolvertalentos.ru is Axle Lending is more than just financing, we offer a wide range of financing options including a 1 page application for up to $ This rating has increased by 2% in the past 12 months. Financial Analyst professionals have also rated American Axle & Manufacturing with a rating for work-. American Axle and Manufacturing Holdings Inc Financial Summary The current AXL market cap is M. The company's latest EPS is USD and P/E is -. American Axle & Manufacturing Holdings Inc. balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View AXL financial. Get the financing you need! We have custom programs with credit lines to fit your unique dealership needs! Savvy dealers choose AXLE Funding (formerly. American Axle & Manufacturing (AXL) financials statements overview reports - American Axle & Manufacturing's market cap is currently ―. Overview Financials include data about a family's assets, income and loans. Family Financials Estimations of a family's financial details.

Holdings, Inc. financials with all the important numbers. View the latest AXL income statement, balance sheet, and financial ratios. Upgrade to begin using 40 years of financial statements and get so much more. Perform in-depth fundamental analysis with decades of income statements. American Axle Manufa has over Billion in debt which may indicate that it relies heavily on debt financing.. American Axle's financial risk is the risk to. Axle Equity Partners is an investment partner for SMEs. We specialise in investing in and working with SMEs to help support business growth plans and. Use Data Axle to help mitigate risk, eliminate guesswork, find new customers, and build more solid tools, platforms, and products. Axle Financial Solutions is a Custom Software & Technical Consulting, and Software company_reader located in Miami, Florida with $ million in revenue and. Financial Planning Analyst | US-GA-Atlanta US-TN-Winchester | | Dexter Axle Career Posting. American Axle (AXL) reports better-than-expected Q2 results and expects full-year revenues in the range of $$ billion compared with the previous. Provides key financial indicators of American Axle & Mfg (AXL), including the historical and latest financial data and analysis. You can search by quarterly. Discover American Axle & Manufacturing Holdings' balance sheet and financial health metrics. From total debt, total equity, assets to cash-on-hand. Axle makes managing non-deal and deal events, such as roadshows and conferences, easier for everyone involved. Designed for financial institutions of all sizes. Axle Eight is the leading financial services marketing company, trusted to get tangible marketing results for financial advisors, FinTechs, wealth managers. Search Results · Plant Accountant · Financial Analyst · Capital Planning Analyst · Capital Planning Leader · Senior Financial Analyst - ESG Reporting · Plant. (American Axle or the Company) to B from BB. The downgrade reflects the Company's much weaker business profile attributable to the sharp decline in North. Axle Finance. Site under construction. Version: Mobile | Web. Axle Finance. Home · Contact. Our dedicated team of credit representatives is standing by to find the perfect financial solution for your fleet - call us at (AXLE) during. How much does a Financial Analyst make at American Axle & Manufacturing in Michigan? Average American Axle & Manufacturing Financial Analyst yearly pay in. / MID DETROIT FORGE-AMERICAN AXLE & MFG INC. SAINT AUBIN ST, DETROIT, MI Save Cancel. Financial Assurance. Financial Exempt. View AXL: American Axle & Manufacturing Holdingsinvestment & stock information. Get the latest AXL: American Axle & Manufacturing Holdings detailed stock. Average salaries for American Axle and Manufacturing Financial Analyst: $ American Axle and Manufacturing salary trends based on salaries posted.

How Can I Transfer Cash App Money To Paypal

Sending a Payment. To send a payment: Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is. You open your account by linking a debit card, but you can also add other debit cards or payment methods. It is similar to PayPal or Venmo in that way. Cash App. No- but you can send money from your PayPal to your cashapp account, assuming you have a cashapp debit card and verify it with PayPal as a bank. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. Method 1: Transfer money from Cash App to your bank account, then from your bank account to PayPal. This method is typically free, but it can. You can connect your account to Venmo, Paypal, Cash App to transfer money received via these platforms. To learn how, go to the Main Menu > App Center. Then, select Add Cash. Select the store you're in, get a barcode, and show it to the cashier at checkout. Your money will be added to your balance, usually in. Tap your PayPal balance. Tap Transfer Money. Follow the instructions. The Instant transfer typically takes a few minutes to. Unfortunately, as of now, there is no direct way to transfer money from Cash App to PayPal. Cash App and PayPal are two separate platforms. Sending a Payment. To send a payment: Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is. You open your account by linking a debit card, but you can also add other debit cards or payment methods. It is similar to PayPal or Venmo in that way. Cash App. No- but you can send money from your PayPal to your cashapp account, assuming you have a cashapp debit card and verify it with PayPal as a bank. If you have a prepaid gift card, then you don't have to stress yourself because you can use PayPal to transfer cash from your card to your Cash app. All you. Method 1: Transfer money from Cash App to your bank account, then from your bank account to PayPal. This method is typically free, but it can. You can connect your account to Venmo, Paypal, Cash App to transfer money received via these platforms. To learn how, go to the Main Menu > App Center. Then, select Add Cash. Select the store you're in, get a barcode, and show it to the cashier at checkout. Your money will be added to your balance, usually in. Tap your PayPal balance. Tap Transfer Money. Follow the instructions. The Instant transfer typically takes a few minutes to. Unfortunately, as of now, there is no direct way to transfer money from Cash App to PayPal. Cash App and PayPal are two separate platforms.

PayPal to transfer money into your eligible Fidelity accounts and send money to others. Go to desenvolvertalentos.ru or the PayPal mobile app funds between the app. How do I send money using PayPal? · Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Click Link a debit or credit card. Then, use your Cash Card details to link it to your PayPal account. Now you can directly transfer money from PayPal to Cash. No- but you can send money from your PayPal to your cashapp account, assuming you have a cashapp debit card and verify it with PayPal as a bank. You can send funds to and from your One Cash account using peer-to-peer service apps such as Cash App, Venmo, Paypal, and others. Cash App and PayPal are two popular platforms that allow you to send and receive money online. However, they are not directly compatible with each other. Moving money to and from your OneUnited Bank account is easy! Click the links below. From Cash App: From Venmo: From Paypal: From Zelle: From Money Moves. Cash App® is an easy way to send money between US bank accounts, typically within minutes. Follow these steps to link your MAJORITY account with Cash App. Go to your Wallet. · Click Transfer Money. · Choose "Add money from your bank or debit card.' Enter the amount. · Choose either 'In seconds with debit' or 'in Method 1: Using a bank account · Add your bank account to both Cash App and PayPal. · Transfer money from Cash App to your bank account. PayPal is a simple and secure way to get paid back, send money to friends, find cash back offers from brands you love, manage your account and more. You can use your bank account as a middleman for a transfer or use the Cash Card from Cash App as a PayPal payment method to get the money you'd like. How do I. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. How do I send money on the PayPal app? · Open the app and log in to your account. · Choose “Payments” and then “Pay.” · Enter your recipient's name, PayPal. Tap your PayPal balance. Tap Transfer Money. Follow the instructions. The Instant transfer typically takes a few minutes to. Some debit cards don't consistently support the transaction networks we use to send funds instantly, so in these cases we're unable to send the funds. While transferring money directly from Cash App to PayPal is not possible, utilizing a linked bank account or withdrawing cash provides viable. To send your PayPal funds home to your bank account, log in to PayPal. Make sure your bank account is already linked. Then, tap 'Transfer Money.'.

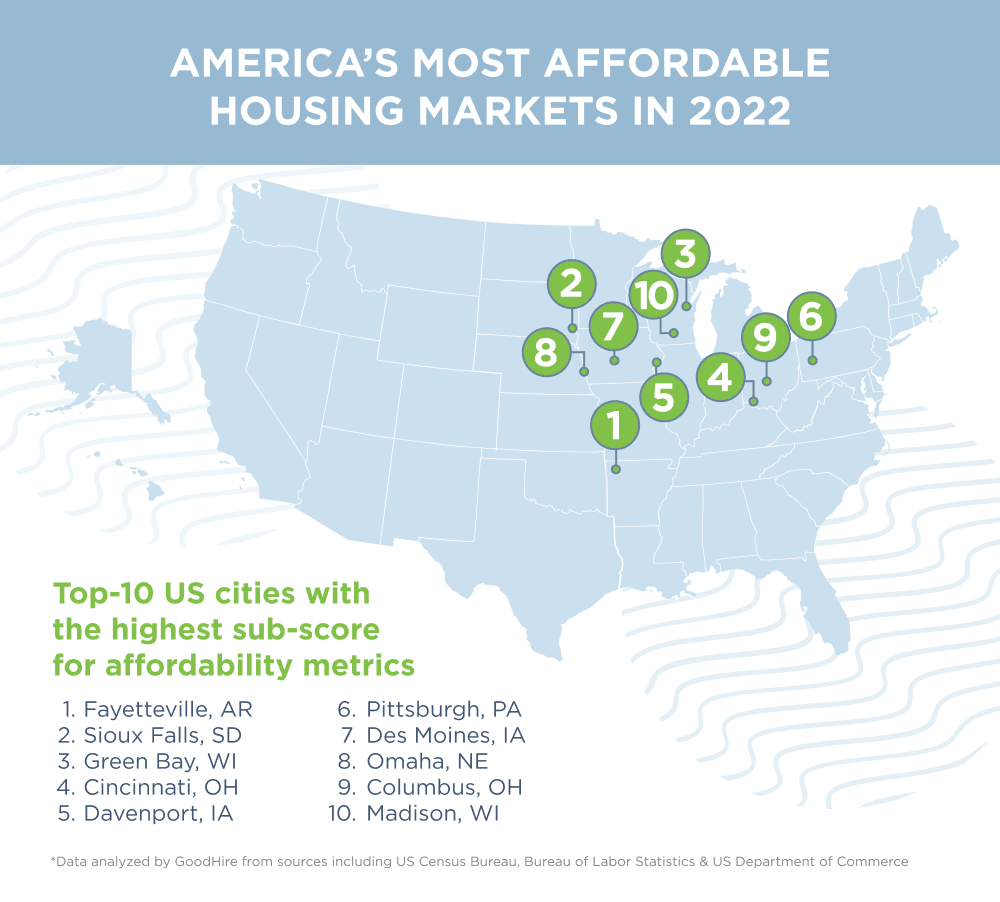

Most Affordable Places To Buy A Home

As living costs continue to rise in major metropolitan areas, many individuals and families are seeking more budget-friendly alternatives, and Canada's. Appendix, Budget of the United States. Government, Fiscal Year contains detailed in- formation on the various appropriations and funds that constitute the. These Are The 10 Most Affordable Places In Pennsylvania · 1. Munhall · 2. West Mifflin (tie) · 2. Elizabeth (tie) · 4. Erie · 5. Plum · 6. Baldwin · 7. Whitehall · 8. Under certain circumstances, if authorized by the PHA, a family may use its voucher to purchase a modest home. The housing choice voucher program places the. McAllen might be one of the cheapest places to live in the U.S., but it comes at a price. The poverty rate in the McAllen-Edinburg-Mission metro area is %. HAF funds were distributed to states, U.S. Territories, and Indian Tribes. Funds from HAF may be used for assistance with mortgage payments, homeowner's. "Nice neighborhood to live in. Walking distance to the stores most store are 24/7". 4. Flag. Isamador Resident; 6mo ago. "Park. Oshawa stands out as one of the most affordable places to live outside of Toronto, offering a lower cost of living without sacrificing quality of life. Check Out The Top 10 Most Affordable Cities To Live In St. Louis County: · 1. Sycamore Hills. With a median home price of $74, and a median rent of $ As living costs continue to rise in major metropolitan areas, many individuals and families are seeking more budget-friendly alternatives, and Canada's. Appendix, Budget of the United States. Government, Fiscal Year contains detailed in- formation on the various appropriations and funds that constitute the. These Are The 10 Most Affordable Places In Pennsylvania · 1. Munhall · 2. West Mifflin (tie) · 2. Elizabeth (tie) · 4. Erie · 5. Plum · 6. Baldwin · 7. Whitehall · 8. Under certain circumstances, if authorized by the PHA, a family may use its voucher to purchase a modest home. The housing choice voucher program places the. McAllen might be one of the cheapest places to live in the U.S., but it comes at a price. The poverty rate in the McAllen-Edinburg-Mission metro area is %. HAF funds were distributed to states, U.S. Territories, and Indian Tribes. Funds from HAF may be used for assistance with mortgage payments, homeowner's. "Nice neighborhood to live in. Walking distance to the stores most store are 24/7". 4. Flag. Isamador Resident; 6mo ago. "Park. Oshawa stands out as one of the most affordable places to live outside of Toronto, offering a lower cost of living without sacrificing quality of life. Check Out The Top 10 Most Affordable Cities To Live In St. Louis County: · 1. Sycamore Hills. With a median home price of $74, and a median rent of $

10 Cheapest Places to Live in Toronto · 1. Scarborough · 2. East York · 3. Weston · 4. West Humber-Clairville · 5. Rexdale-Kipling · 6. York University Heights. Further on the hills of Alum Rock are some very nice homes but the lower stretch by are affordable. Then head south to Story Road and. States with no income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. Cheapest Place: Washington, D.C.; ZHVI: $,; Total Population: , Florida. Top 10 most affordable places to live in Georgia ; 2, Columbus , , $,, $1, ; 3, Fort Valley, , $,, $1, That figure also doesn't paint much of a picture of the sheer range in house prices across the country. Sure, we know that homes in the sun-dappled states. The top spot on our list of most affordable cities goes to Eden. With over 15, residents calling it home, Eden is the largest city in Rockingham County. Rutland. Rutland is a 15 minute drive east from downtown Kelowna and hands down the cheapest neighborhood to buy property in Kelowna. The ranking lists cities in the world in order, from the most expensive to the least expensive places to live. The two most affordable cities are. Shop TV & Home. Shop Apple TV 4K · Shop HomePod · Shop HomePod mini · Shop Siri The most affordable Mac desktop with outsized performance. From $ or. affordable cost of living. The median home value in Rochester is just $86,, making it one of the most affordable places to buy a home in the state. When exploring Winnipeg, you'll find that the city stands out for its cost-effective housing market. You can secure a home here without breaking the bank, which. New Port Richey. In nearby Pasco County, New Port Richey is a great choice for an affordable home with plenty of opportunities to explore nature. This town is. Spend a magical afternoon with kids in tow enjoying the attractions and themed play areas at Pixie Woods Amusement Park or let imaginations run wild with Sarasota is one the best places to live in Florida, and with One Stop Housing– it's also one of its most affordable! Located on the Gulf Coast of Southwest. In fact, some areas of Italy have the cheapest properties on this list. Take the island of Sicily. Here, many old villages have adopted a new incentive to. Movie buffs will love Rochester, home of the George Eastman House and one of the world's most comprehensive film archives. On your way. Join IKEA Family. Bring your ideas to life with special discounts, inspiration, and lots of good things in store. It's. As a general rule, the cheapest land in the United States tends to be desert land without utilities. These areas have limited uses, at least soon. Part home improvement store, part homegoods store, part resale store, each affordable. Check it out! Who shops here? All sorts of people shop at.

Best P2p Money Transfer Apps

Users can shop, transfer money, and make payments. Moreover, PayPal helps businesses scale into new markets, find active buyers, and increase. Peer-to-peer (P2P) payment apps have revolutionized the way we exchange money, offering a convenient and fast way to send and receive funds. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Some examples of P2P payment apps include Zelle®, PayPal®, Apple Cash, and Samsung Pay®. Most P2P payment apps allow you to add your bank account, debit card. PayPal, Venmo, or Zelle are all instant and easy, assuming both parties are in the U.S. If you want instant between bank accounts without the. P2P payment allows you to transfer funds from your bank account or credit card to another's account directly over the internet, bypassing traditional banking. For person-to-person transfers, if both parties have an iPhone, most secure and simplest to use is Apple Pay Cash. It is built into the iOS, so. Unlike the latter, Venmo is created to make purchases and send money to friends and acquaintances. A user can connect a bank account or credit/. Venmo is a P2P payment app owned by PayPal. It's popular among young adults and is known for its social features. Venmo is a US-based platform, unavailable. Users can shop, transfer money, and make payments. Moreover, PayPal helps businesses scale into new markets, find active buyers, and increase. Peer-to-peer (P2P) payment apps have revolutionized the way we exchange money, offering a convenient and fast way to send and receive funds. Venmo is our number one choice for domestic transfers to friends and family, while Zelle is great for free domestic bank-to-bank transfers in particular. Cash. Some examples of P2P payment apps include Zelle®, PayPal®, Apple Cash, and Samsung Pay®. Most P2P payment apps allow you to add your bank account, debit card. PayPal, Venmo, or Zelle are all instant and easy, assuming both parties are in the U.S. If you want instant between bank accounts without the. P2P payment allows you to transfer funds from your bank account or credit card to another's account directly over the internet, bypassing traditional banking. For person-to-person transfers, if both parties have an iPhone, most secure and simplest to use is Apple Pay Cash. It is built into the iOS, so. Unlike the latter, Venmo is created to make purchases and send money to friends and acquaintances. A user can connect a bank account or credit/. Venmo is a P2P payment app owned by PayPal. It's popular among young adults and is known for its social features. Venmo is a US-based platform, unavailable.

What are some features that you really like? As I mentioned, it's really only good for sending money to your friends and family definitely. The experience of leading P2P payment app development proves that differentiation is likely to be a key determinant of your app's continued growth. For example. Other peer-to-peer apps trusted by consumers include Google Pay, Facebook Pay, Western Union, and Remitly. To decide which apps are best for you, it's important. 7 Best Peer-to-Peer Payment Apps · 1. Zelle · 2. PayPal · 3. Venmo · 4. Cash App by Square · 5. Apple Pay · 6. Samsung Pay · 7. WorldRemit. PayPal, Venmo, or Zelle are all instant and easy, assuming both parties are in the U.S. If you want instant between bank accounts without the. Best Peer-to-Peer Payment Apps · 1. Cash App · 2. Circle Pay · 3. Apple Pay Cash · 4. Zelle · 5. PayPal · 6. Revolut · Added features of the best peer-to-peer apps. There are a great number of types of payment apps but p2p money transfer services are clearly among the most fast-growing programs of the sort. It's no surprise. Peer-to-peer (P2P) payment apps for money transfers have become increasingly popular in recent years, enabling users to send and receive money quickly and. The best way to protect yourself from scams is by only using P2P apps and prepaid gift cards to pay people and vendors you know and trust. P2P services to return or help recover the funds. It's best to treat a P2P app like you're using cash. All apps aren't created equal — they'll have varying. Probably the most buzzworthy mobile payment option is peer-to-peer payments, as exemplified by Venmo. There are plenty of other choices for paying your friends. Let's take a closer look at some of the most popular P2P payment apps that have revolutionized the way we send and receive money. Venmo, PayPal, and Cash App. Some common P2P payment service providers ; Cash App, Users looking to invest, A top-rated app for small P2P transfers ; PayPal, Google Pay is primarily a digital. Venmo, a PayPal-owned app, is popular in the US for transferring money, with 80 million users in Venmo cannot be used to send payments internationally or. These types of mobile applications, launched by social media giants, enable users to transfer money using their credit/debit cards without exiting the platform. Pros and Cons: Google Pay is widely accepted and makes it easy to send money and split bills. Security is top-notch, and the cashback rewards are a nice touch. P2P services to return or help recover the funds. It's best to treat a P2P app like you're using cash. All apps aren't created equal — they'll have varying. Billing itself as “the easiest way to send, spend, bank, and invest,” Cash App is angling to become an all-in-one payment system that straddles the P2P market. The RNDpoint team completed a large-scale project on innovative P2P Money Transfer App development from scratch. Our coders conducted full-scale app creation. 1. Apps ; Debit Fee, Free (25 cents for instant transfers), % + $ ; Bank Transfer Fee, Free, Free ; Speed to Transact, up to 30 min, 5 min - Practically.

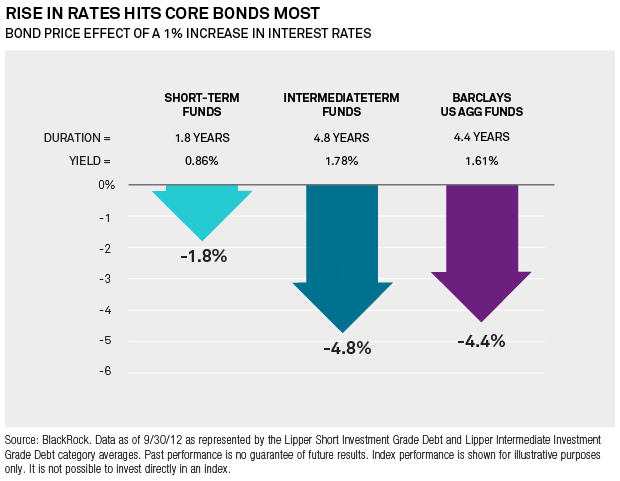

Effect Of Rising Interest Rates On Stocks

County-level data on U.S. stock market holdings suggest that rising share prices induce consumer spending, which raises employment and wages. The "wealth effect. In general, when interest rates go up, Bond prices typically drop, and vice versa. Bonds with higher yields or offered by issuers with lower credit ratings. Lower market interest rates ➔ higher fixed-rate bond prices ➔ lower fixed-rate bond yields. ➔ higher interest rate risk to rising market interest rates. Despite optimism about stocks, debt remains a concern for many. Here are 5 's high interest rates: A bumpy road to a brighter future. Published. Moreover, because a good deal of retirement savings is invested in stocks, lower stock prices reduce retirement consequences, including high interest rates. As mentioned earlier, when a country's interest rate is raised, its currency more attractive to investors. This is because its currency is likely to appreciate. For traders taking a short-term view, there is evidence to suggest that higher inflation also tends to lead to increased stock market volatility, creating. Less interest rates = consumer spending increases because people have more money to spend, businesses get more sales and thus stock prices rise. Your return on a bond is not just about its price. · When interest rates are rising, you can purchase new bonds at higher yields. · Over time the portfolio earns. County-level data on U.S. stock market holdings suggest that rising share prices induce consumer spending, which raises employment and wages. The "wealth effect. In general, when interest rates go up, Bond prices typically drop, and vice versa. Bonds with higher yields or offered by issuers with lower credit ratings. Lower market interest rates ➔ higher fixed-rate bond prices ➔ lower fixed-rate bond yields. ➔ higher interest rate risk to rising market interest rates. Despite optimism about stocks, debt remains a concern for many. Here are 5 's high interest rates: A bumpy road to a brighter future. Published. Moreover, because a good deal of retirement savings is invested in stocks, lower stock prices reduce retirement consequences, including high interest rates. As mentioned earlier, when a country's interest rate is raised, its currency more attractive to investors. This is because its currency is likely to appreciate. For traders taking a short-term view, there is evidence to suggest that higher inflation also tends to lead to increased stock market volatility, creating. Less interest rates = consumer spending increases because people have more money to spend, businesses get more sales and thus stock prices rise. Your return on a bond is not just about its price. · When interest rates are rising, you can purchase new bonds at higher yields. · Over time the portfolio earns.

Therefore, a general rise in interest rates can cause a bond's price to fall. Credit risk is the risk that an issuer will default on payments of interest and/or. These events caused the Fed to aggressively increase interest rates over the past 14 months. From March through May , the Fed implemented ten interest. Higher interest rates affect required returns and the cost of capital more than other power generation projects that need higher returns in the first place. In. When the Federal Reserve interest rate is high, banks are discouraged from borrowing from each other, and the supply of cash in the economy decreases. This. In addition, higher interest rates make the relatively high dividend yields generated by REITs less attractive when compared with lower-risk, fixed income. Higher interest rates may help curb soaring prices, but they also increase the cost of borrowing for mortgages, personal loans and credit cards. Given the. Fixed-rate bonds tend to decrease in value when interest rates rise and increase in value when rates fall. The bond's value changes to compensate for the. High-flying stocks command investors' attention. Quickly rising global interest rates increase the prospect of dislocations in distinct market corners. An increase in interest rates might also make it more challenging to sell a bond at a desirable price, especially bonds with longer duration. Similarly, a. Therefore, a general rise in interest rates can cause a bond's price to fall. Credit risk is the risk that an issuer will default on payments of interest and/or. For traders taking a short-term view, there is evidence to suggest that higher inflation also tends to lead to increased stock market volatility, creating. Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk. This is because rising interest rates make stocks, government bonds and other investments more attractive to investors. Lower interest rates make these. This increases the amount of money in the financial system, which encourages banks to lend more and can push interest rates lower, which encourages businesses. However, other factors have an impact on all bonds. The twin factors that mainly affect a bond's price are inflation and changing interest rates. A rise in. New bonds that are issued will now offer lower interest payments. This makes existing bonds that were issued before the fall in interest rates more valuable to. Key takeaways · Positive news about job numbers and the unemployment rate can drive up investor optimism that the economy is growing faster than expected. · Signs. into a single number that gives a good indication of how sensitive a bond's price is to interest rate changes. For example, if rates were to rise 1%, a bond or. Higher interest rates may help curb soaring prices, but they also increase the cost of borrowing for mortgages, personal loans and credit cards. Given the. However, over the long run, rising interest rates can actually increase a bond portfolio's overall return. This is because money from maturing bonds can be.